Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 9

Payroll entries

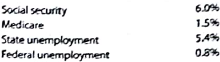

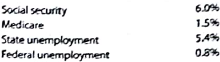

Widmer Company had gross wages of $240,000 during the week ended June 17. The amount of wages subject to social security tax was $240,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows:

The total amount withheld from employee wages for federal taxes was $48,000.

A. Journalize the entry to record the payroll for the week of June 17.

B. Journalize the entry to record the payroll tax expense incurred for the week of June 17.

Widmer Company had gross wages of $240,000 during the week ended June 17. The amount of wages subject to social security tax was $240,000, while the amount of wages subject to federal and state unemployment taxes was $35,000. Tax rates are as follows:

The total amount withheld from employee wages for federal taxes was $48,000.

A. Journalize the entry to record the payroll for the week of June 17.

B. Journalize the entry to record the payroll tax expense incurred for the week of June 17.

التوضيح

Payroll:

The amount paid to the employe...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255