Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 14

Statement of cash flows-indirect method

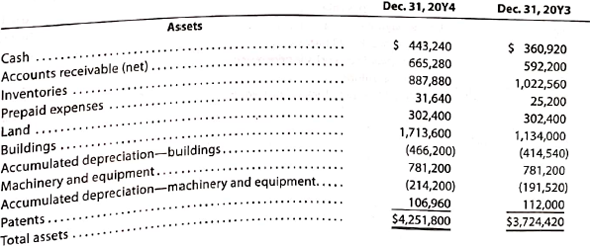

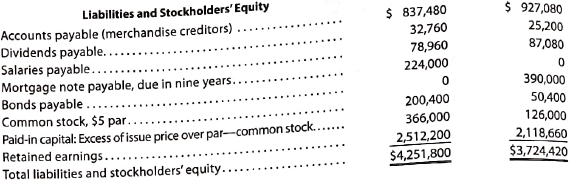

The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows:

An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4:

A. Net income, $524,580.

B. Depreciation expense reported on the income statement: buildings, $51,660; machinery and equipment, $22,680.

C. Patent amortization reported on the income statement, $5,040.

D. A building was constructed for $579,600.

E. A mortgage note for $224,000 was issued for cash.

F. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable.

G. Cash dividends declared, $131,040.

Instructions

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows:

An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4:

A. Net income, $524,580.

B. Depreciation expense reported on the income statement: buildings, $51,660; machinery and equipment, $22,680.

C. Patent amortization reported on the income statement, $5,040.

D. A building was constructed for $579,600.

E. A mortgage note for $224,000 was issued for cash.

F. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable.

G. Cash dividends declared, $131,040.

Instructions

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.

التوضيح

Cash flow from operating activities can ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255