Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 20

AT T and Facebook: Free cash flow

AT T Inc. is a leading global provider of telecommunication services. Facebook, Inc. is a major worldwide social media company. AT T has a lengthy history and was founded by Alexander Graham Bell. Facebook has a short history and was founded by Mark Zuckerberg. Facebook uses telecommunication networks, like those of AT T, to deliver social content to its users. Free cash flow and revenue information for both companies for three recent years is as follows (in millions):

AT T

Information from the statement of cash flows:

Information from the income statement:

Facebook

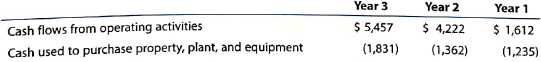

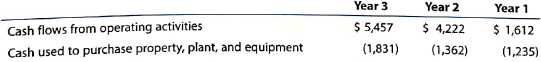

Information from the statement of cash flows:

Information from the income statement:

A. Using total revenue, which company appears to be the larger at the end of Year 3?

B. Using total revenue, which company appears to be growing faster across the three years?

C. Compute the cash used to purchase property, plant, and equipment (PP E) as a percent of the cash flows from operating activities for all three years for each company. (Round to nearest whole percent.)

D. Using the computations in (C), which company appears to require more cash to purchase PP E, and what impact does this have on free cash flow?

E. Compute the ratio of free cash flow to revenue for all three years for each company, and plot the data on a line chart with the years on the horizontal axis.

F. Interpret the chart.

AT T Inc. is a leading global provider of telecommunication services. Facebook, Inc. is a major worldwide social media company. AT T has a lengthy history and was founded by Alexander Graham Bell. Facebook has a short history and was founded by Mark Zuckerberg. Facebook uses telecommunication networks, like those of AT T, to deliver social content to its users. Free cash flow and revenue information for both companies for three recent years is as follows (in millions):

AT T

Information from the statement of cash flows:

Information from the income statement:

Information from the statement of cash flows:

Information from the income statement:

A. Using total revenue, which company appears to be the larger at the end of Year 3?

B. Using total revenue, which company appears to be growing faster across the three years?

C. Compute the cash used to purchase property, plant, and equipment (PP E) as a percent of the cash flows from operating activities for all three years for each company. (Round to nearest whole percent.)

D. Using the computations in (C), which company appears to require more cash to purchase PP E, and what impact does this have on free cash flow?

E. Compute the ratio of free cash flow to revenue for all three years for each company, and plot the data on a line chart with the years on the horizontal axis.

F. Interpret the chart.

التوضيح

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255