Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 56

Measures of liquidity, solvency and profitability

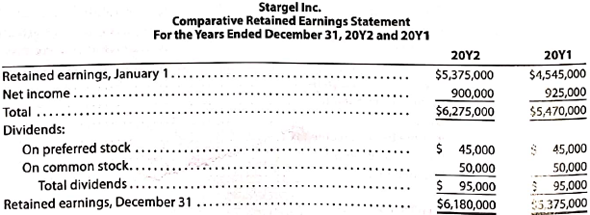

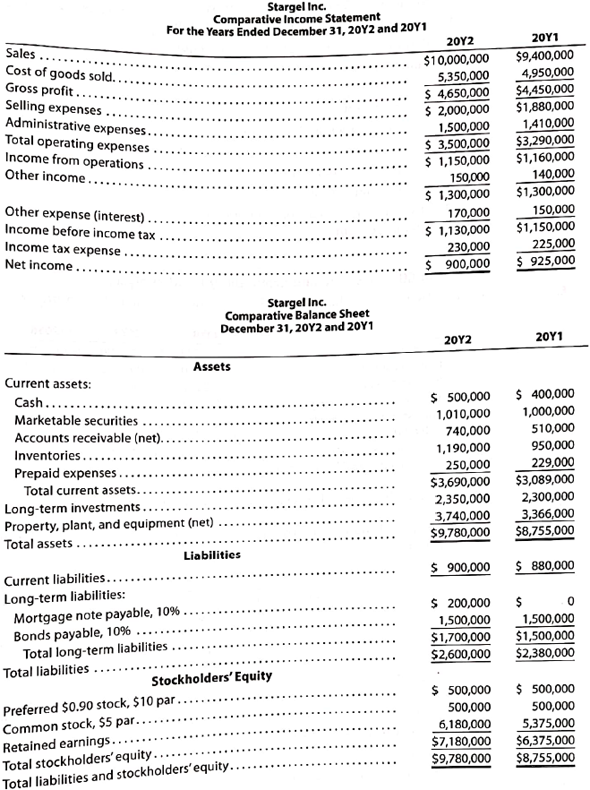

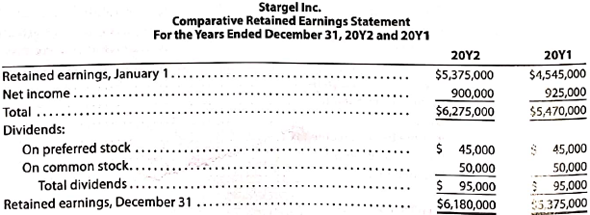

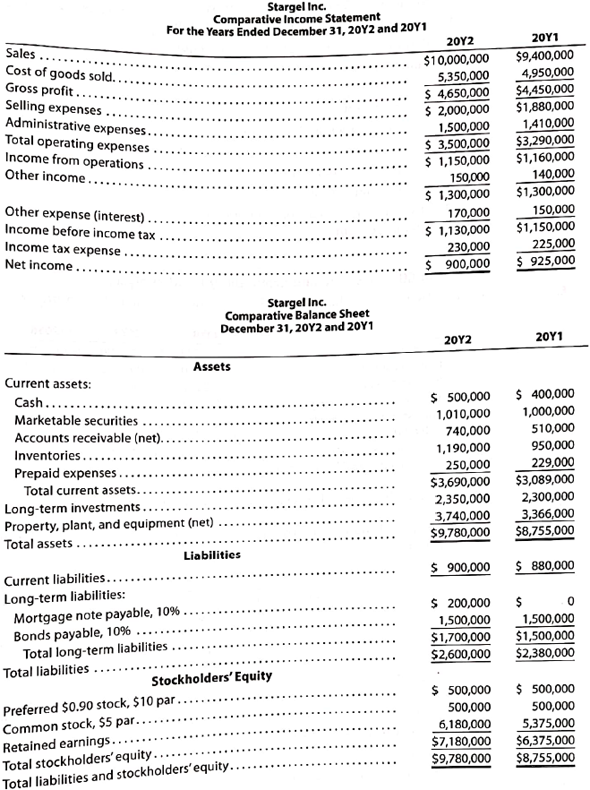

The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2.

Instructions

Determine the following measures for 20Y2 (round to one decimal place including percentages, except for per-share amounts)

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Number of days' sales in receivables

6. Inventory turnover

7. Number of days' sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of libilities to stockholders' equity

10. Times interest earned

11. Asset turnover

12. Return on total assets

13. Return on stockholders' equity

14. Return on common stockholders' equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividends yield

The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2.

Instructions

Determine the following measures for 20Y2 (round to one decimal place including percentages, except for per-share amounts)

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Number of days' sales in receivables

6. Inventory turnover

7. Number of days' sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of libilities to stockholders' equity

10. Times interest earned

11. Asset turnover

12. Return on total assets

13. Return on stockholders' equity

14. Return on common stockholders' equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividends yield

التوضيح

Financial ratios

A financial ratio refe...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255