Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 2

Solvency and profitability trend analysis

Crosby Company has provided the following comparative information:

You have been asked to evaluate the historical performance of the company over the last five years.

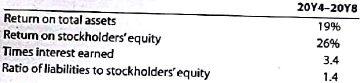

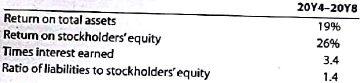

Selected industry ratio have remained relatively steady at the following levels for the last five years:

Instructions

1. Prepare four line graphs with the ratio on the vertical axis and the years on the horizontal axis for the following four ratios (round ratios and percentages to one decimal place):

A. Return on total assets

B. Return on stockholders' equity

C. Times interest earned

D. Ratio of liabilities to stockholders' equity

Display both the company ratio and the industry benchmark on each graph. That is, each graph should have two lines.

2. Prepare an analysis of the graphs in (1).

Crosby Company has provided the following comparative information:

You have been asked to evaluate the historical performance of the company over the last five years.

Selected industry ratio have remained relatively steady at the following levels for the last five years:

Instructions

1. Prepare four line graphs with the ratio on the vertical axis and the years on the horizontal axis for the following four ratios (round ratios and percentages to one decimal place):

A. Return on total assets

B. Return on stockholders' equity

C. Times interest earned

D. Ratio of liabilities to stockholders' equity

Display both the company ratio and the industry benchmark on each graph. That is, each graph should have two lines.

2. Prepare an analysis of the graphs in (1).

التوضيح

Profitability analysis

The analysis of ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255