Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 23

Ratio of liabilities to stockholders' equity and times interest eamed

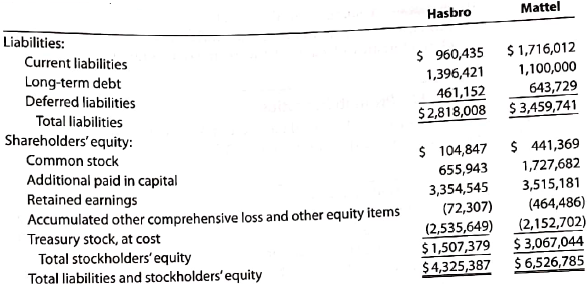

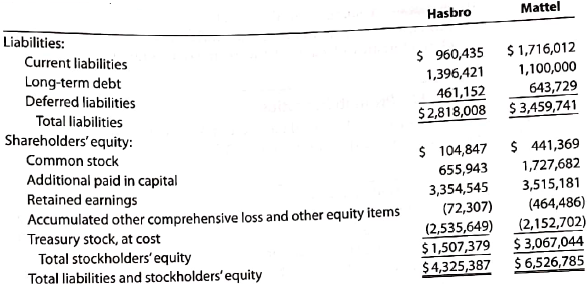

Hasbro, Inc. and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders' equity from a recent balance sheet are shown for each company as follows (in thousands):

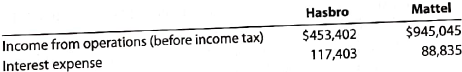

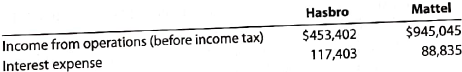

The income from operations and interest expense from the income statement for each company were as follows (in thousands):

A. Determine the ratio of liabilities to stockholders' equity for both companies. (Round to one decimal place.)

B. Detemine the times interest earned ratio for both companies. (Round to one decimal place.)

C. Interpret the ratio differences between the two companies.

Hasbro, Inc. and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders' equity from a recent balance sheet are shown for each company as follows (in thousands):

The income from operations and interest expense from the income statement for each company were as follows (in thousands):

A. Determine the ratio of liabilities to stockholders' equity for both companies. (Round to one decimal place.)

B. Detemine the times interest earned ratio for both companies. (Round to one decimal place.)

C. Interpret the ratio differences between the two companies.

التوضيح

a. Ratio of liabilities to stockholders'...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255