Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 14الرقم المعياري الدولي: 978-1305653535 تمرين 38

Profitability ratios

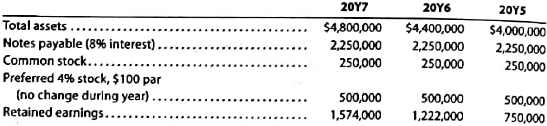

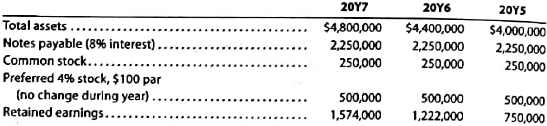

The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5:

The 20Y7 net income was $372,000, and the 20Y6 net income was $492,000. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7.

A. Determine the return on total assets, the rate earned on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. (Round percentages to one decimal place.)

B. What conclusions can be drawn from these data as to the company's profitability?

The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5:

The 20Y7 net income was $372,000, and the 20Y6 net income was $492,000. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7.

A. Determine the return on total assets, the rate earned on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. (Round percentages to one decimal place.)

B. What conclusions can be drawn from these data as to the company's profitability?

التوضيح

Analysis of Portfolio

The analysis of p...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255