Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 1

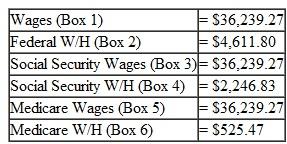

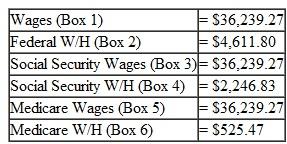

Jin Xiang is single and lives at 2468 North Lake Road in Lakeland, MN. Her SSN is 412-34-5670. She worked the entire year for Lakeland Automotive. The Form W-2 from Lakeland contained information in the following boxes:

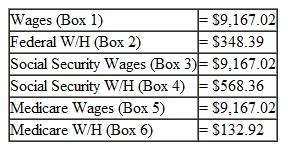

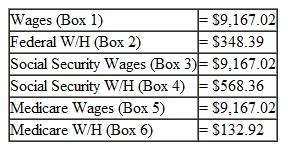

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Prepare a Form 1040EZ for Jin.

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes:

On the weekends, Jin worked at Parts-Galore, a local auto parts store. The Form W-2 from Parts-Galore contained information in the following boxes: Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.

Jin also received a Form 1099-INT from Minnesota Savings and Loan. The amount of interest income in box 1 of the Form 1099-INT was $51.92.Prepare a Form 1040EZ for Jin.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255