Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 5

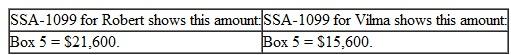

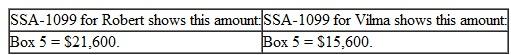

Robert and Vilma Greene are married filing jointly. They are 68 and 66 years old, respectively. Their address is 1001 N.W. 93 Street, Miami, Florida 33022. Additional information about Mr. and Mrs. Greene, who are retired, is as follows:

Social security numbers:

Robert: 412-34-5670. Vilma: 412-34-5671.

Form 1099-INT for Robert shows this amount:

Form 1099-INT for Robert shows this amount:

Box 1 = $9,100 from CD Bank.

Form 1099-INT for Vilma shows this amount:

Box 1 = $7,500 from CD Bank.

Prepare the tax return for Mr. and Mrs. Greene using the appropriate form. They want to contribute to the presidential election campaign.

Social security numbers:

Robert: 412-34-5670. Vilma: 412-34-5671.

Form 1099-INT for Robert shows this amount:

Form 1099-INT for Robert shows this amount:Box 1 = $9,100 from CD Bank.

Form 1099-INT for Vilma shows this amount:

Box 1 = $7,500 from CD Bank.

Prepare the tax return for Mr. and Mrs. Greene using the appropriate form. They want to contribute to the presidential election campaign.

التوضيح

Adjusted Gross Incom...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255