Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 39

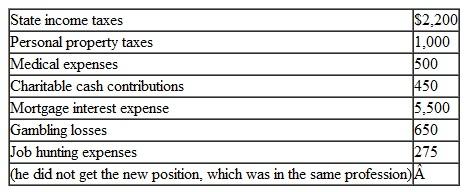

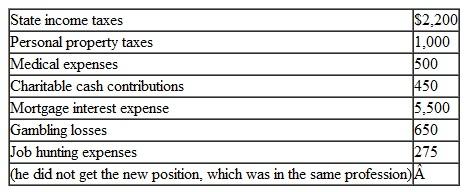

Jonathan Michaels is single, has no dependents, has $55,000 in wages and lives at 55855 Ridge Dr. in Santa Fe, New Mexico. His social security number is 412-34-5670 and he has federal withholding is $11,000. He has gambling winnings of $500 and the following expenses:

Prepare a Form 1040 and Schedule A and Schedule M for Jonathan using the appropriate worksheets and forms. Do not compute the underpayment penalty.

Prepare a Form 1040 and Schedule A and Schedule M for Jonathan using the appropriate worksheets and forms. Do not compute the underpayment penalty.

Prepare a Form 1040 and Schedule A and Schedule M for Jonathan using the appropriate worksheets and forms. Do not compute the underpayment penalty.

Prepare a Form 1040 and Schedule A and Schedule M for Jonathan using the appropriate worksheets and forms. Do not compute the underpayment penalty.التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255