Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 23

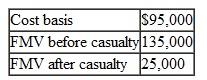

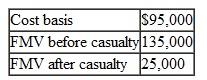

In 2010, the Bells' vacation cottage was severely damaged by an earthquake in an area not declared a federal disaster area. They had AGI of $110,000 in 2010. Following is information related to the cottage:

The Bells had insurance and received an $80,000 insurance settlement.

The Bells had insurance and received an $80,000 insurance settlement.

What is the amount of allowable casualty loss deduction for the Bells in 2010 before the AGI and event limitation?

A) $13,500.

B) $14,900

C) $15,000

D) $40,000

The Bells had insurance and received an $80,000 insurance settlement.

The Bells had insurance and received an $80,000 insurance settlement.What is the amount of allowable casualty loss deduction for the Bells in 2010 before the AGI and event limitation?

A) $13,500.

B) $14,900

C) $15,000

D) $40,000

التوضيح

C - $95,000 - 80,000 = $15,000...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255