Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 12

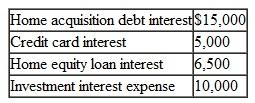

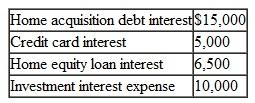

Tyrone and Akira incurred and paid the following amounts of interest during 2010:

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.

With 2010 investment interest income of $2,000, calculate the amount of their allowable deduction for investment interest and their total deduction for allowable interest. Home acquisition principal is less than $1,000,000, and the home equity loan is less than $100,000.التوضيح

a. Investment interest expense...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255