Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 33

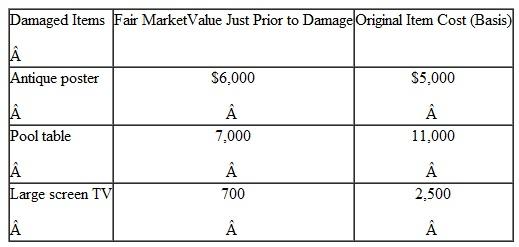

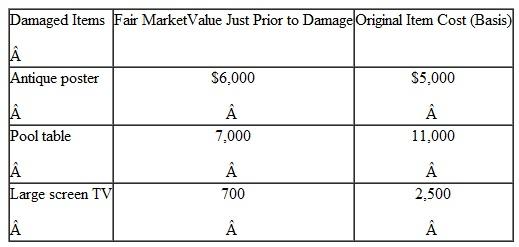

Reynaldo and Sonya, a married couple, had flood damage in their home due to a faulty water heater during 2010, which ruined the furniture in their garage. The following items were completely destroyed and not salvageable.

Their homeowner's insurance policy had a $10,000 deductible for the personal property, which was deducted from their insurance reimbursement of $12,700, resulting in a net payment of $2,700. Their AGI for 2010 was $30,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2010?

Their homeowner's insurance policy had a $10,000 deductible for the personal property, which was deducted from their insurance reimbursement of $12,700, resulting in a net payment of $2,700. Their AGI for 2010 was $30,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2010?

Their homeowner's insurance policy had a $10,000 deductible for the personal property, which was deducted from their insurance reimbursement of $12,700, resulting in a net payment of $2,700. Their AGI for 2010 was $30,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2010?

Their homeowner's insurance policy had a $10,000 deductible for the personal property, which was deducted from their insurance reimbursement of $12,700, resulting in a net payment of $2,700. Their AGI for 2010 was $30,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2010?التوضيح

Income tax:

Every earner pays a tax on ...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255