Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 41

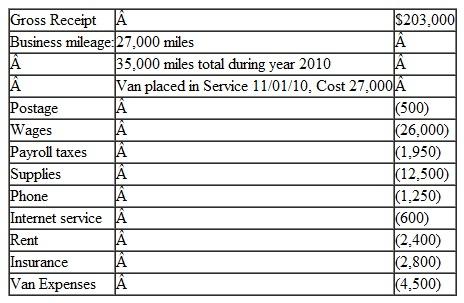

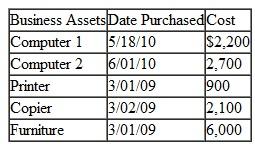

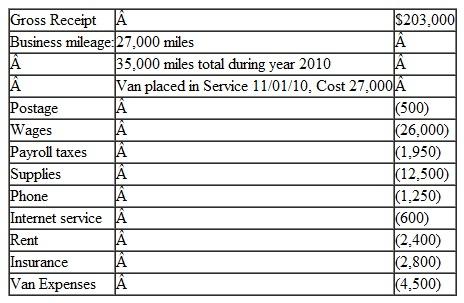

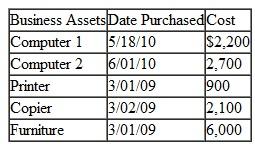

Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2010:

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.

Determine Cassi's self-employment income and prepare Schedule C and Schedule SE. §179 expense is elected on all eligible assets (§179 was not taken on assets purchased last year). The 50% was elected on all 2009 assets.التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255