Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 8

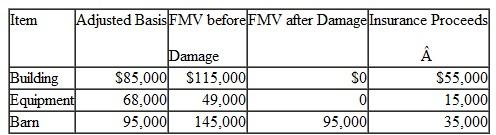

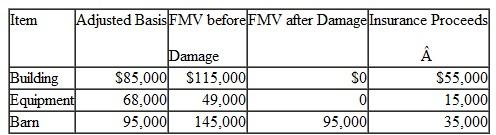

Derrick owns a farm in eastern North Carolina. A hurricane hit the area and destroyed a farm building and some farm equipment and damaged a barn.

Due to the extensive damage throughout the area, the President of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $45,000 of taxable income last year. Their taxable income for the current year is $150,000, excluding the loss from the hurricane. Calculate the amount of the loss by Derrick and his wife and the years in which they should deduct the loss ( Hint : Chapter 5 provides information concerning nationally declared disaster areas).

Due to the extensive damage throughout the area, the President of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $45,000 of taxable income last year. Their taxable income for the current year is $150,000, excluding the loss from the hurricane. Calculate the amount of the loss by Derrick and his wife and the years in which they should deduct the loss ( Hint : Chapter 5 provides information concerning nationally declared disaster areas).

Due to the extensive damage throughout the area, the President of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $45,000 of taxable income last year. Their taxable income for the current year is $150,000, excluding the loss from the hurricane. Calculate the amount of the loss by Derrick and his wife and the years in which they should deduct the loss ( Hint : Chapter 5 provides information concerning nationally declared disaster areas).

Due to the extensive damage throughout the area, the President of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $45,000 of taxable income last year. Their taxable income for the current year is $150,000, excluding the loss from the hurricane. Calculate the amount of the loss by Derrick and his wife and the years in which they should deduct the loss ( Hint : Chapter 5 provides information concerning nationally declared disaster areas).التوضيح

Case Fact:

Individuals tax payers may d...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255