Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 40

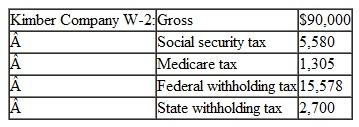

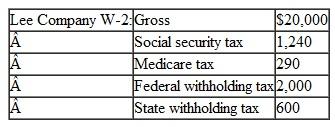

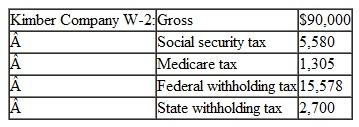

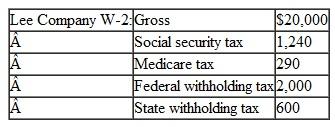

Janis Blakeley is single and lives at 5411 Melbourne Avenue, Chicago, IL, 60455. Her SSN is 412-34-5670. Using the following information, complete her tax return for 2010:

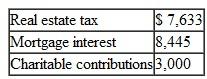

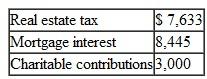

Janis has the following itemized deductions:

Janis has the following itemized deductions:

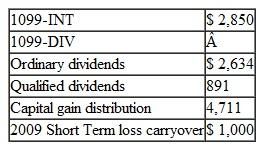

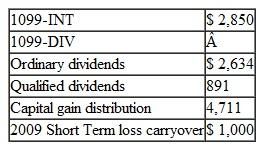

Janis has the following investments:

Janis has the following investments:

Janis received a gift of 2,000 shares of FNP Inc. stock from her Aunt Jane on January 19, 2010. The basis of the shares to Aunt Jane was $3,300, and they had a FMV of $3,600 on the date of the gift. Aunt Jane purchased the stock on December 30, 2009. On June 30, 2010, Janis sold all the shares for $5,000.

Janis received a gift of 2,000 shares of FNP Inc. stock from her Aunt Jane on January 19, 2010. The basis of the shares to Aunt Jane was $3,300, and they had a FMV of $3,600 on the date of the gift. Aunt Jane purchased the stock on December 30, 2009. On June 30, 2010, Janis sold all the shares for $5,000.

Janis is an avid stamp collector and purchased a rare stamp on March 20, 2005, for $4,000. She sold the stamp for $6,000 on April 8, 2010.

Prepare Form 1040 and all related schedules, forms, and worksheets for 2010. Janis does not donate to the Presidential Election Campaign.

Janis has the following itemized deductions:

Janis has the following itemized deductions: Janis has the following investments:

Janis has the following investments: Janis received a gift of 2,000 shares of FNP Inc. stock from her Aunt Jane on January 19, 2010. The basis of the shares to Aunt Jane was $3,300, and they had a FMV of $3,600 on the date of the gift. Aunt Jane purchased the stock on December 30, 2009. On June 30, 2010, Janis sold all the shares for $5,000.

Janis received a gift of 2,000 shares of FNP Inc. stock from her Aunt Jane on January 19, 2010. The basis of the shares to Aunt Jane was $3,300, and they had a FMV of $3,600 on the date of the gift. Aunt Jane purchased the stock on December 30, 2009. On June 30, 2010, Janis sold all the shares for $5,000.Janis is an avid stamp collector and purchased a rare stamp on March 20, 2005, for $4,000. She sold the stamp for $6,000 on April 8, 2010.

Prepare Form 1040 and all related schedules, forms, and worksheets for 2010. Janis does not donate to the Presidential Election Campaign.

التوضيح

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255