Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 41

Derrick and Ani Jones are married taxpayers, filing jointly. They live at 474 Rustic Drive, Spokane, Washington 99201. Derrick works as the director of information systems at Washington Community College District (WCCD). Ani is a stay-at-home mom. Their son, Jackson, is 5 years old. Their SSN's are Derrick, 412-34-5670; Ani, 412-34-5671; and Jackson, 412-34-5672. The Joneses own their home and paid $15,000 in mortgage interest during the year to Washington Mutual and property taxes of $3,200. They have no other deductible expenses.

The Form W-2 Derrick received from WCCD contained the following information:

Box 1 = $79,002.50

Box 2 = $ 8,000.14

Box 3 = $79,002.50

Box 4 = $ 4,898.15

Box 5 = $79,002.50

Box 6 = $ 1,145.54

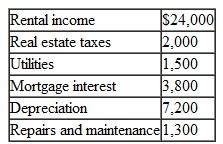

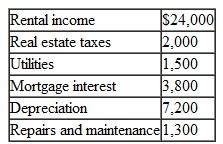

In addition, the Joneses own a small four-unit rental near their home at 12345 Rainbow Way, Sultan, Washington 98294. The rental was purchased and placed in service on July 1, 2002, and was rented for the entire year. The following income and expense information relate to the rental activity. For the purpose of this return problem, do not consider passive activity rules or limitations.

Prepare the Joneses' federal tax return for 20010Use Form 1040, Schedule A, Schedule E, and other appropriate schedules. Do not complete Form 4562 or 8829 and assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions.

Prepare the Joneses' federal tax return for 20010Use Form 1040, Schedule A, Schedule E, and other appropriate schedules. Do not complete Form 4562 or 8829 and assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions.

The Form W-2 Derrick received from WCCD contained the following information:

Box 1 = $79,002.50

Box 2 = $ 8,000.14

Box 3 = $79,002.50

Box 4 = $ 4,898.15

Box 5 = $79,002.50

Box 6 = $ 1,145.54

In addition, the Joneses own a small four-unit rental near their home at 12345 Rainbow Way, Sultan, Washington 98294. The rental was purchased and placed in service on July 1, 2002, and was rented for the entire year. The following income and expense information relate to the rental activity. For the purpose of this return problem, do not consider passive activity rules or limitations.

Prepare the Joneses' federal tax return for 20010Use Form 1040, Schedule A, Schedule E, and other appropriate schedules. Do not complete Form 4562 or 8829 and assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions.

Prepare the Joneses' federal tax return for 20010Use Form 1040, Schedule A, Schedule E, and other appropriate schedules. Do not complete Form 4562 or 8829 and assume they do not qualify for any credits (although they may). For any missing information, make reasonable assumptions.التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255