Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 15

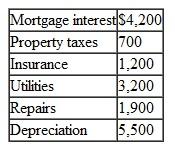

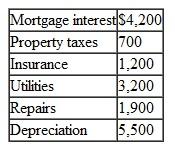

Matt and Marie own a vacation home at the beach. During the year, they rented the house for 42 days (6 weeks) at $890 per week and used it for personal use for 58 days. The total costs of maintaining the home are as follows:

a. What is the proper tax treatment of this information on their tax return using the Tax Court method?

a. What is the proper tax treatment of this information on their tax return using the Tax Court method?

b. Is there an option for how to allocate the expense between personal and rental use? Explain.

c. What is the proper tax treatment if Matt and Marie rented the house for only 14 days?

a. What is the proper tax treatment of this information on their tax return using the Tax Court method?

a. What is the proper tax treatment of this information on their tax return using the Tax Court method?b. Is there an option for how to allocate the expense between personal and rental use? Explain.

c. What is the proper tax treatment if Matt and Marie rented the house for only 14 days?

التوضيح

Income tax is the tax paid by individual...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255