Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 42

Juliette White is a head of household taxpayer with an 8-year-old daughter named Sabrina. They live at 1009 Olinda Terrace Apt 5B, Reno, NV 78887. Juliette works as a receptionist at a local law firm, Law Offices of Dane Gray, and attends school in the evenings at Reno Community College (RCC). She is taking some general classes and is not sure what degree she wants to pursue yet. She is taking three units this semester. Full-time status at RCC is nine units. Fortunately, Sabrina goes to a free after-school program at her elementary school, Mondays through Thursdays until 4PM. On Fridays, Juliette works half a day to spend more time with Sabrina. Juliette's mother watches Sabrina two nights a week so that Juliette can take classes at RCC. SSNs are as follows: Juliette, 412-34-5670; and Sabrina, 412-34-5672.

The Form W-2 Juliette received from the Law Offices of Dane Gray contained information in the following boxes:

Box 1 = $19,502.50

Box 2 = $ 2,000.14

Box 3 = $19,502.50

Box 4 = $ 1,209.16

Box 5 = $19,502.50

Box 6 = $ 282.79

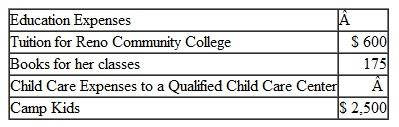

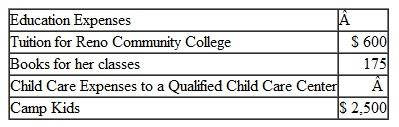

In addition, Juliette had the following expenses:

Prepare Juliette's federal tax return for 2010. Use Form 1040 and any appropriate schedules or forms she may need for credits. For any missing information, make reasonable assumptions.

Prepare Juliette's federal tax return for 2010. Use Form 1040 and any appropriate schedules or forms she may need for credits. For any missing information, make reasonable assumptions.

The Form W-2 Juliette received from the Law Offices of Dane Gray contained information in the following boxes:

Box 1 = $19,502.50

Box 2 = $ 2,000.14

Box 3 = $19,502.50

Box 4 = $ 1,209.16

Box 5 = $19,502.50

Box 6 = $ 282.79

In addition, Juliette had the following expenses:

Prepare Juliette's federal tax return for 2010. Use Form 1040 and any appropriate schedules or forms she may need for credits. For any missing information, make reasonable assumptions.

Prepare Juliette's federal tax return for 2010. Use Form 1040 and any appropriate schedules or forms she may need for credits. For any missing information, make reasonable assumptions.التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255