Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 30

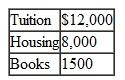

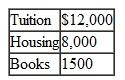

Darren paid the following expenses during November 2010 for his son Sean's college expenses for spring 2011 semester, which begins in January 2011.

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

A) $3,500.

B) $8,000.

C) $12,000.

D) $14,000.

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?

In addition, Sean's uncle paid $500 in fees on behalf of Sean directly to the college. Sean is claimed as Darren's dependent on his tax return. How much of the above paid expenses qualify for the purpose of the education credit deduction for Darren in 2010?A) $3,500.

B) $8,000.

C) $12,000.

D) $14,000.

التوضيح

Every earner pays a tax on the income ge...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255