Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 45

Kia Lopez (SSN 121-12-1212) resides at 101 Poker Street, Apt. 12A, Hickory, FL 12345.

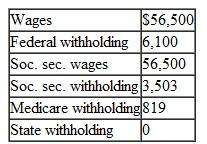

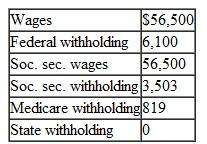

Her W-2 shows the following:

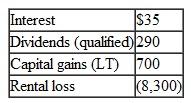

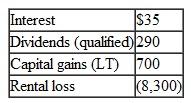

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

Prepare Form 1040 for Kia Lopez for 2009. You will need Form 1040, Schedule E (page 2), Form 6198, and Form 8582.

Her W-2 shows the following:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows:

In 2009, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia's share of ARLP income and losses for the year per her K-1 were as follows: ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.

ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities.Prepare Form 1040 for Kia Lopez for 2009. You will need Form 1040, Schedule E (page 2), Form 6198, and Form 8582.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255