Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

النسخة 4الرقم المعياري الدولي: 978-0078110993 تمرين 43

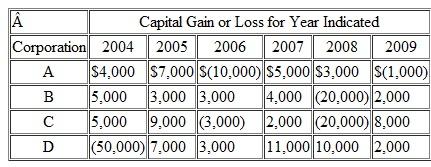

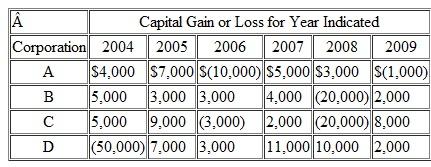

For each of the following cases, determine the amount of capital gain or loss to report in each year (after taking into account any applicable carrybacks) and the capital loss carryforward to 2010, if any. Assume that 2004 is the first year of operation for each corporation.

التوضيح

Capital gain and losses:

Corporates and...

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255