International Economics 10th Edition by Paul Krugman,Maurice Obstfeld ,Marc Melitz

النسخة 10الرقم المعياري الدولي: 978-0133423648

International Economics 10th Edition by Paul Krugman,Maurice Obstfeld ,Marc Melitz

النسخة 10الرقم المعياري الدولي: 978-0133423648 تمرين 2

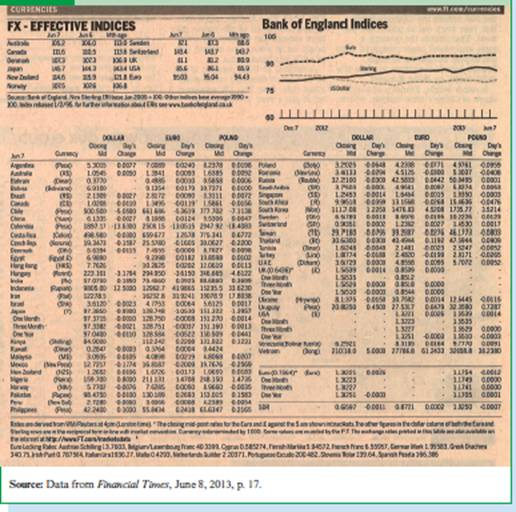

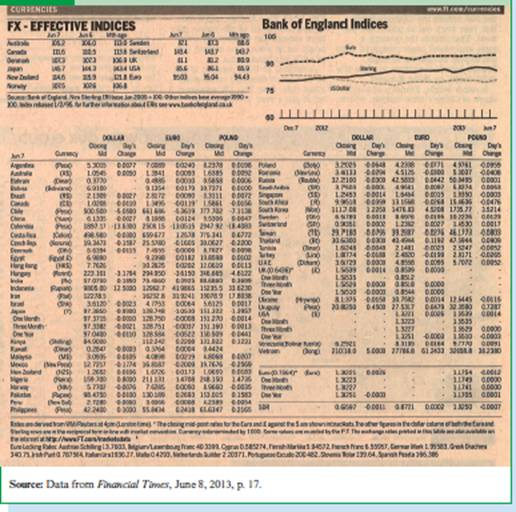

As defined in footnote 3, cross exchange rates are exchange rates quoted against currencies other than the U.S. dollar. If you return to Table, you will notice that it lists not only exchange rates against the dollar, but also cross rates against the euro and the pound sterling. The fact that we can derive the Swiss franc/Israeli shekel exchange rate, say, from the dollar/franc rate and the dollar/shekel rate follows from ruling out a potentially profitable arbitrage strategy known as triangular arbitrage. As an example, suppose the Swiss franc price of a shekel were below the Swiss franc price of a dollar times the dollar price of a shekel. Explain why, rather than buying shekels with dollars, it would be cheaper to buy Swiss francs with dollars and use the francs to buy the shekels. Thus, the hypothesized situation offers a riskless profit opportunity and therefore is not consistent with profit maximization.

Exchange Rate Quotations

Exchange Rate Quotations

التوضيح

Suppose it is cheaper to purchase Swiss ...

International Economics 10th Edition by Paul Krugman,Maurice Obstfeld ,Marc Melitz

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255