College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958 تمرين 29

Recording sales and cash receipts for a retail store.

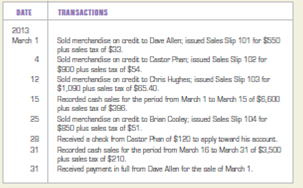

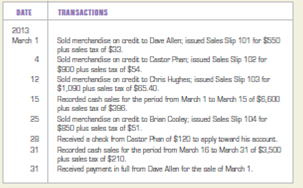

Amanda's Appliances began operations March 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During March, Amanda's Appliances engaged in the following transactions:

INSTRUCTIONS

1. Open the general ledger accounts indicated below.

2. Record the transactions in a general journal. Use 1 as the journal page number.

3. Post the entries from the general journal to the appropriate general ledger accounts.

GENERAL LEDGER ACCOUNTS

Analyze: What were the total cash receipts during March?

Amanda's Appliances began operations March 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During March, Amanda's Appliances engaged in the following transactions:

INSTRUCTIONS

1. Open the general ledger accounts indicated below.

2. Record the transactions in a general journal. Use 1 as the journal page number.

3. Post the entries from the general journal to the appropriate general ledger accounts.

GENERAL LEDGER ACCOUNTS

Analyze: What were the total cash receipts during March?

التوضيح

Recording sale made on account with a sa...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255