College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958 تمرين 1

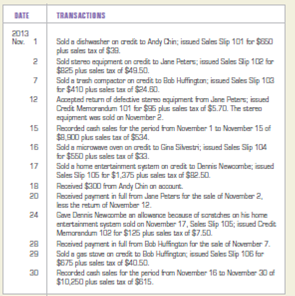

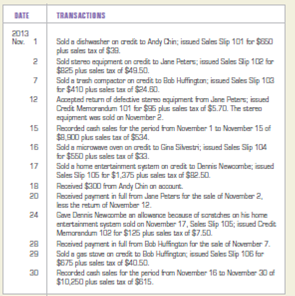

Recording sales, sales returns, and cash receipts for a retail store.

The Appliance Discounter began operations November 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, The Appliance Discounter engaged in the following transactions:

INSTRUCTIONS

Record the transactions in a general journal. Use 1 as the journal page number.

Analyze: What is the total amount due from Bob Huffington for the November 29 sale?

The Appliance Discounter began operations November 1, 2013. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, The Appliance Discounter engaged in the following transactions:

INSTRUCTIONS

Record the transactions in a general journal. Use 1 as the journal page number.

Analyze: What is the total amount due from Bob Huffington for the November 29 sale?

التوضيح

Recording sale made on account with a sa...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255