College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958 تمرين 18

Posting transactions to the general ledger and accounts receivable ledger.

INSTRUCTIONS

1. Open the general ledger accounts and accounts receivable ledger accounts indicated below.

2. Post the entries from the general journal in Problem 7.2A to the appropriate accounts in the general ledger and in the accounts receivable ledger.

3. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

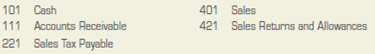

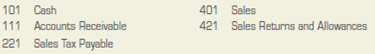

GENERAL LEDGER ACCOUNTS

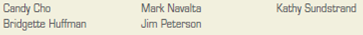

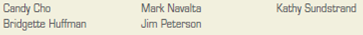

ACCOUNTS RECEIVABLE LEDGER ACCOUNTS

Analyze: What is the amount of sales tax owed at September 30, 2013?

INSTRUCTIONS

1. Open the general ledger accounts and accounts receivable ledger accounts indicated below.

2. Post the entries from the general journal in Problem 7.2A to the appropriate accounts in the general ledger and in the accounts receivable ledger.

3. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

GENERAL LEDGER ACCOUNTS

ACCOUNTS RECEIVABLE LEDGER ACCOUNTS

Analyze: What is the amount of sales tax owed at September 30, 2013?

التوضيح

Recording sale made on account with a sa...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255