College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

النسخة 2الرقم المعياري الدولي: 978-0073396958 تمرين 29

Computing and recording employer's payroll tax expense.

The payroll register of Cliff's Auto Detailers showed total employee earnings of $4,000 for the week ended April 8, 2013.

INSTRUCTIONS

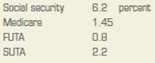

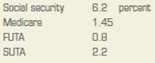

1. Compute the employer's payroll taxes for the period. The tax rates are as follows:

2. Prepare a general journal entry to record the employer's payroll taxes for the period. Use journal page 28.

Analyze: If the FUTA tax rate had been 1.2 percent, what total employer payroll taxes would have been recorded?

The payroll register of Cliff's Auto Detailers showed total employee earnings of $4,000 for the week ended April 8, 2013.

INSTRUCTIONS

1. Compute the employer's payroll taxes for the period. The tax rates are as follows:

2. Prepare a general journal entry to record the employer's payroll taxes for the period. Use journal page 28.

Analyze: If the FUTA tax rate had been 1.2 percent, what total employer payroll taxes would have been recorded?

التوضيح

1.

Compute the payroll taxes of C Auto D...

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255