Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532 تمرين 49

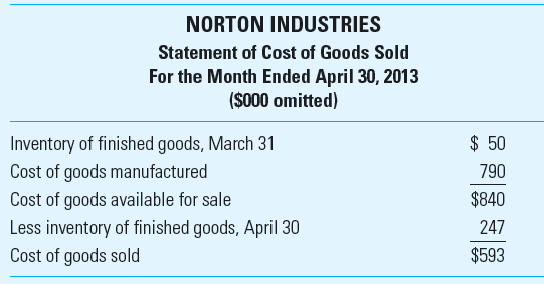

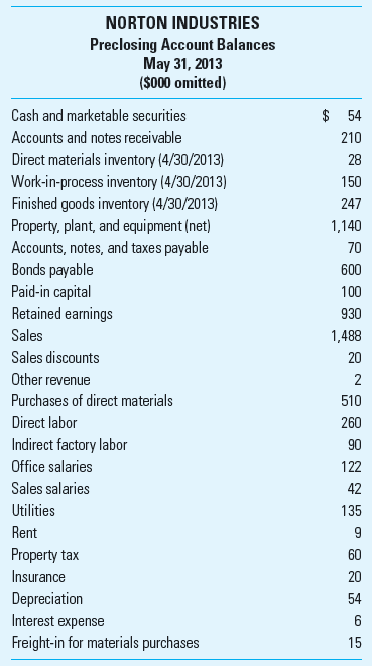

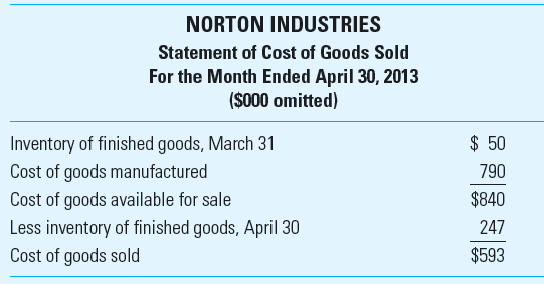

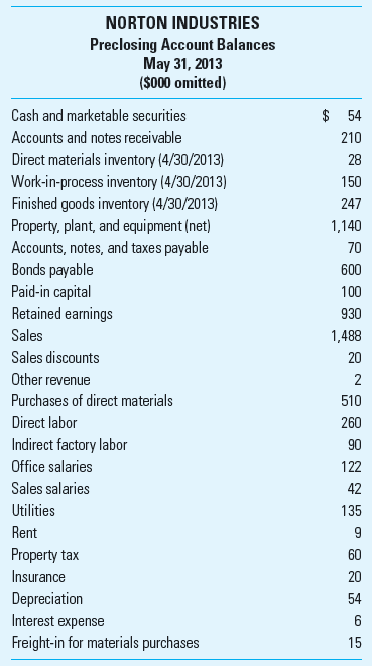

Cost of Goods Manufactured; Income Statement Norton Industries, a manufacturer of cable for the heavy construction industry, closes its books and prepares financial statements at the end of each month. The statement of cost of goods sold for April 2013 follows:

Additional Information

• Of the utilities, 80% relates to manufacturing the cable; the remaining 20% relates to the sales and administrative functions.

• All rent is for the office building.

• Property taxes are assessed on the manufacturing plant.

• Of the insurance, 60% is related to manufacturing the cable; the remaining 40% is related to the sales and administrative functions.

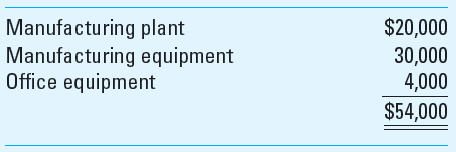

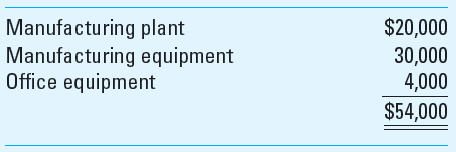

• Depreciation expense includes the following:

• The company manufactured 7,825 tons of cable during May 2013.

• The inventory balances at May 31, 2013, follow:

• Direct materials inventory $23,000

• Work-in-process inventory $220,000

• Finished goods inventory $175,000

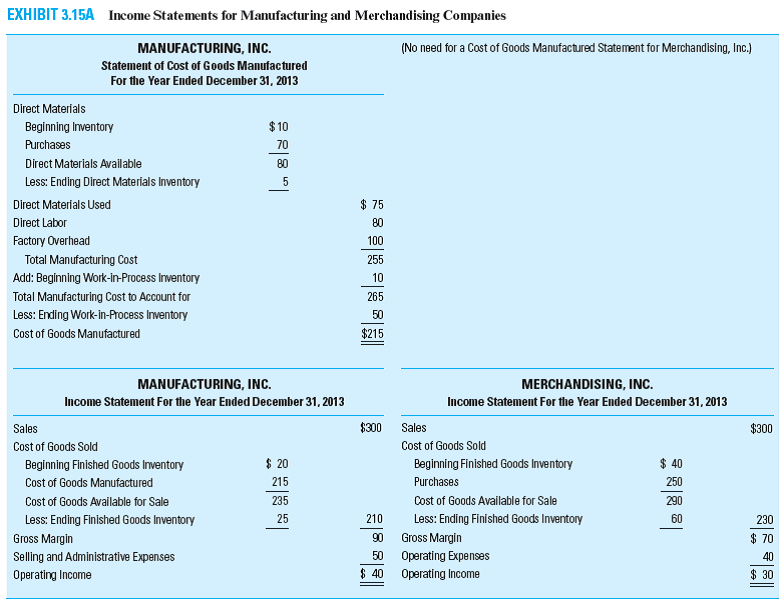

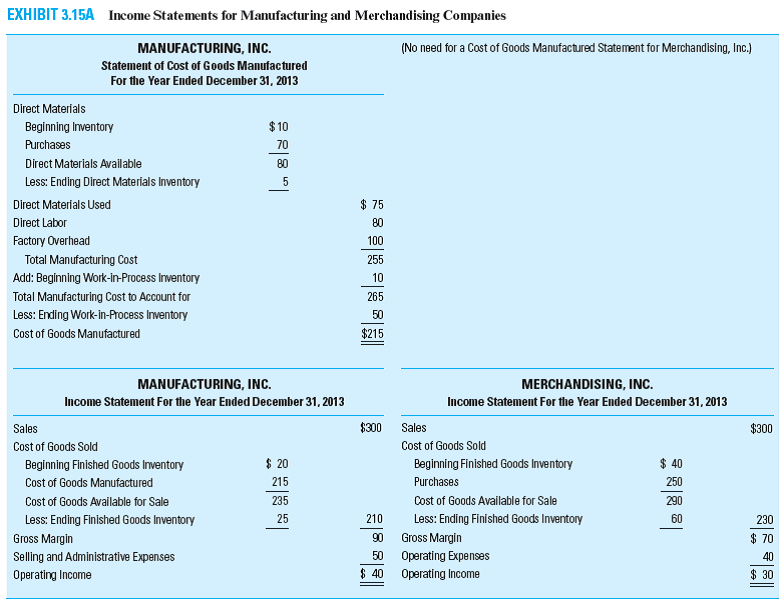

Required Based on Exhibit 3.15 A, prepare the following:

1. Statement of cost of goods manufactured for Norton Industries for May 2013.

2. Income statement for Norton Industries for May 2013.

Reference:

Additional Information

• Of the utilities, 80% relates to manufacturing the cable; the remaining 20% relates to the sales and administrative functions.

• All rent is for the office building.

• Property taxes are assessed on the manufacturing plant.

• Of the insurance, 60% is related to manufacturing the cable; the remaining 40% is related to the sales and administrative functions.

• Depreciation expense includes the following:

• The company manufactured 7,825 tons of cable during May 2013.

• The inventory balances at May 31, 2013, follow:

• Direct materials inventory $23,000

• Work-in-process inventory $220,000

• Finished goods inventory $175,000

Required Based on Exhibit 3.15 A, prepare the following:

1. Statement of cost of goods manufactured for Norton Industries for May 2013.

2. Income statement for Norton Industries for May 2013.

Reference:

التوضيح

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255