Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532 تمرين 34

Volume-Based Costing versus ABC West Chemical Company produces three products. The operating results of 2013 are:

The firm sets the target price of each product at 150% of the product's total manufacturing cost. Recognizing that the firm was able to sell Product C at a much higher price than the target price of the product and lost money on Product B, Tom Watson, CEO, wants to promote Product C much more aggressively and phase out Product B. He believes that the information suggests that Product C has the greatest potential among the firm's three products since the actual selling price of Product C was almost 50% higher than the target price while the firm was forced to sell Product B at a price below the target price.

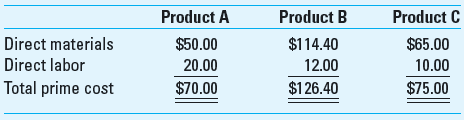

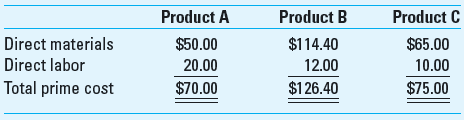

Both the budgeted and actual factory overheads for 2013 are $493,000. The actual units sold for each product also are the same as the budgeted units. The firm uses direct labor dollars to assign manufacturing overhead costs. The direct materials and direct labor costs per unit for each product are:

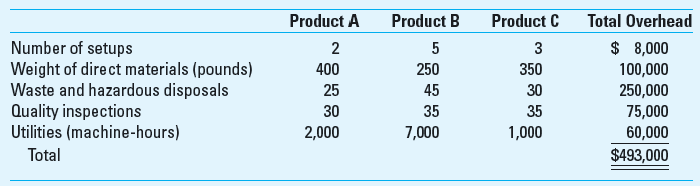

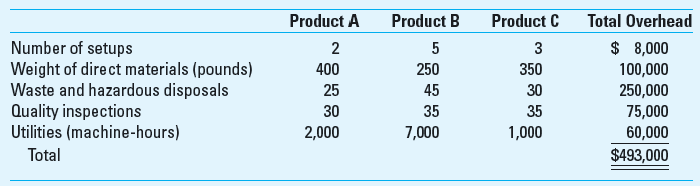

The controller noticed that not all products consumed factory overhead similarly. Upon further investigations, she identified the following usage of factory overhead during 2013:

Required

1. Determine the manufacturing cost per unit for each of the products using the volume-based method.

2. What is the least profitable and the most profitable product under both the current and the ABC costing systems

3. What is the new target price for each product based on 150% of the new costs under the ABC system Compare this price with the actual selling price.

4. Comment on the result from a competitive and strategic perspective. As a manager of West Chemical, describe what actions you would take based on the information provided by the activity-based unit costs.

The firm sets the target price of each product at 150% of the product's total manufacturing cost. Recognizing that the firm was able to sell Product C at a much higher price than the target price of the product and lost money on Product B, Tom Watson, CEO, wants to promote Product C much more aggressively and phase out Product B. He believes that the information suggests that Product C has the greatest potential among the firm's three products since the actual selling price of Product C was almost 50% higher than the target price while the firm was forced to sell Product B at a price below the target price.

Both the budgeted and actual factory overheads for 2013 are $493,000. The actual units sold for each product also are the same as the budgeted units. The firm uses direct labor dollars to assign manufacturing overhead costs. The direct materials and direct labor costs per unit for each product are:

The controller noticed that not all products consumed factory overhead similarly. Upon further investigations, she identified the following usage of factory overhead during 2013:

Required

1. Determine the manufacturing cost per unit for each of the products using the volume-based method.

2. What is the least profitable and the most profitable product under both the current and the ABC costing systems

3. What is the new target price for each product based on 150% of the new costs under the ABC system Compare this price with the actual selling price.

4. Comment on the result from a competitive and strategic perspective. As a manager of West Chemical, describe what actions you would take based on the information provided by the activity-based unit costs.

التوضيح

1.

Volume Based Costing

Working Note...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255