Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532 تمرين 31

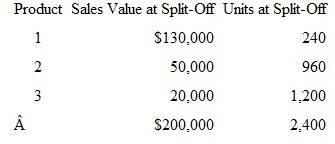

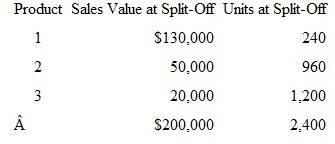

Require the following information about a joint production process for three products, with a total joint production cost of $100,000. There are no separable processing costs for any of the three products.

Assume that the total sales value at the split-off point for product 1 is $50,000 instead of $130,000 and the sales value of product 3 is $2,000 instead of $20,000. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint cost would be allocated to the three products

Assume that the total sales value at the split-off point for product 1 is $50,000 instead of $130,000 and the sales value of product 3 is $2,000 instead of $20,000. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint cost would be allocated to the three products

Assume that the total sales value at the split-off point for product 1 is $50,000 instead of $130,000 and the sales value of product 3 is $2,000 instead of $20,000. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint cost would be allocated to the three products

Assume that the total sales value at the split-off point for product 1 is $50,000 instead of $130,000 and the sales value of product 3 is $2,000 instead of $20,000. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint cost would be allocated to the three productsالتوضيح

Net Realizable value method of Joint pro...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255