Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

النسخة 6الرقم المعياري الدولي: 978-0078025532 تمرين 47

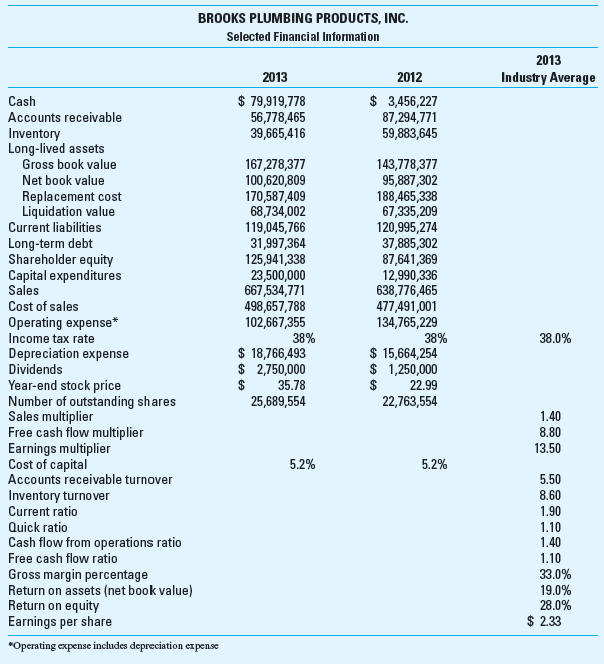

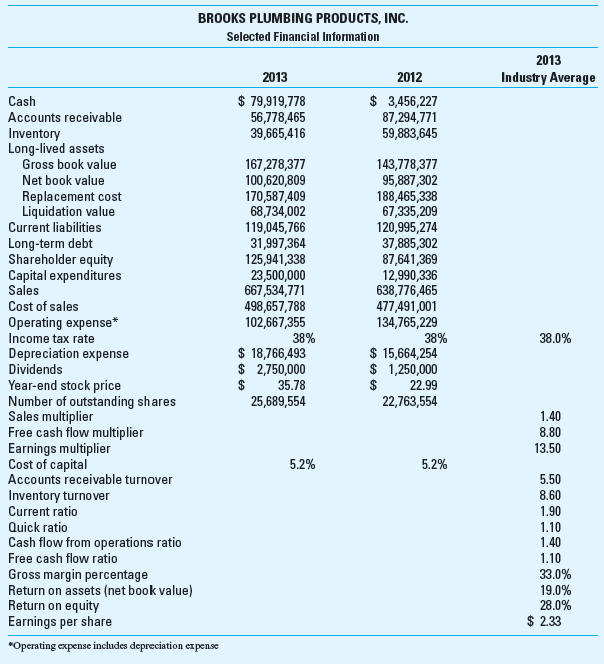

Business Analysis Brooks Plumbing Products, Inc. (BPP) manufactures plumbing fixtures and other home improvement products that are sold in Home Depot and Walmart as well as hardware stores. BPP has a solid reputation for providing value products, good quality, and a good price. The company has been approached by an investment banking firm representing a third company, Garden Specialties Inc. (GSI), that is interested in acquiring BPP. The acquiring firm (GSI) is a retailer of garden supplies; it sees the potential synergies of the combined firm and is willing to pay BPP shareholders $38 cash per share for their stock, which is greater than the current stock price; the stock has traded at about $35 in recent months. Summary financial information about BPP follows.

Required Evaluate BPP as a company using financial ratio analysis. Since the calculation of some ratios requires the averaging of balances, you may assume that the balances in 2011 are the same as those in 2012.

Required Evaluate BPP as a company using financial ratio analysis. Since the calculation of some ratios requires the averaging of balances, you may assume that the balances in 2011 are the same as those in 2012.

التوضيح

Here we have been provided with the raw ...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255