Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314 تمرين 8

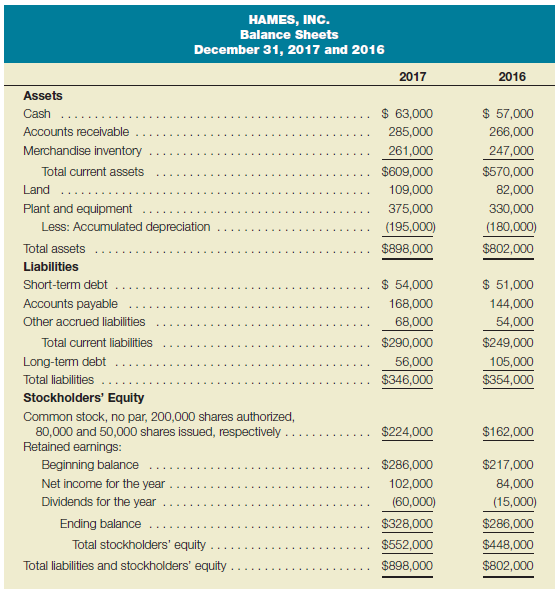

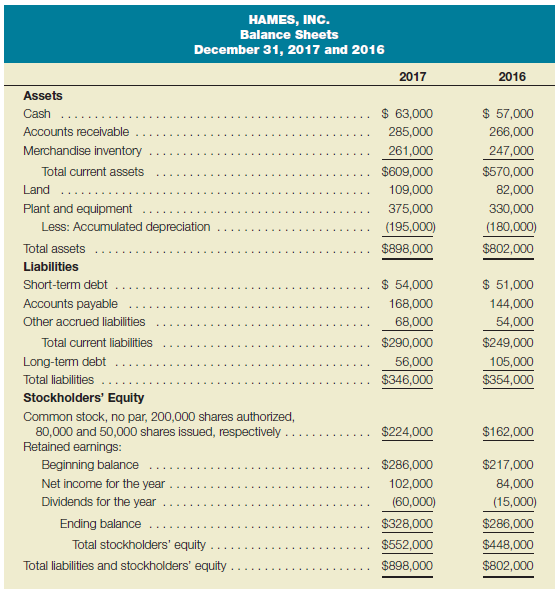

Calculate profitability and liquidity measures Presented here are the comparative balance sheets of Hames, Inc., at December 31, 2017 and 2016. Sales for the year ended December 31, 2017, totaled $1,700,000.

Required:

a. Calculate ROI for 2017. Round your percentage answer to two decimal places.

b. Calculate ROE for 2017. Round your percentage answer to one decimal place.

c. Calculate working capital at December 31, 2017.

d. Calculate the current ratio at December 31, 2017. Round your answer to two decimal places.

e. Calculate the acid-test ratio at December 31, 2017. Round your answer to two decimal places.

f. Assume that on December 31, 2017, the treasurer of Hames, Inc., decided to pay $50,000 of accounts payable. Explain what impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect).

g. Assume that instead of paying $50,000 of accounts payable on December 31, 2017, Hames, Inc., collected $50,000 of accounts receivable. Explain what impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect).

Required:

a. Calculate ROI for 2017. Round your percentage answer to two decimal places.

b. Calculate ROE for 2017. Round your percentage answer to one decimal place.

c. Calculate working capital at December 31, 2017.

d. Calculate the current ratio at December 31, 2017. Round your answer to two decimal places.

e. Calculate the acid-test ratio at December 31, 2017. Round your answer to two decimal places.

f. Assume that on December 31, 2017, the treasurer of Hames, Inc., decided to pay $50,000 of accounts payable. Explain what impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect).

g. Assume that instead of paying $50,000 of accounts payable on December 31, 2017, Hames, Inc., collected $50,000 of accounts receivable. Explain what impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect).

التوضيح

(a)The 2017 balance sheet for H Inc. is ...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255