Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314 تمرين 14

Analysis of accounts receivable and allowance for bad debts-determine beginning balances A portion of the current assets section of the December 31, 2017, balance sheet for Carr Co. is presented here:

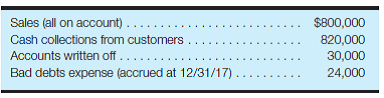

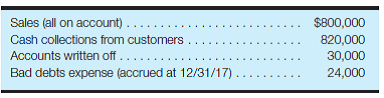

The company's accounting records revealed the following information for the year ended December 31, 2017:

Required:

Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time. (Hint: Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.)

The company's accounting records revealed the following information for the year ended December 31, 2017:

Required:

Using the information provided for 2017, calculate the net realizable value of accounts receivable at December 31, 2016, and prepare the appropriate balance sheet presentation for Carr Co., as of that point in time. (Hint: Use T-accounts to analyze the Accounts Receivable and Allowance for Bad Debts accounts. Remember that you are solving for the beginning balance of each account.)

التوضيح

Calculate the net realizable value of ac...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255