Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314 تمرين 9

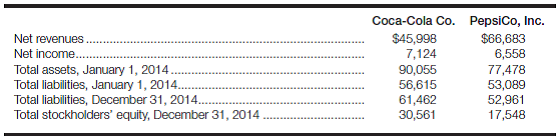

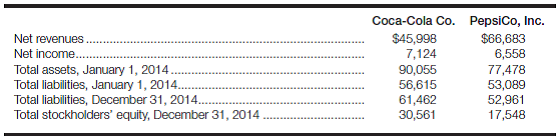

Analytical case-comparative analysis of profitability and financial leverage measures The annual reports of the Coca-Cola Co. and PepsiCo, Inc., indicate the following for the year ended December 31, 2014 (amounts in millions):

Required:

a. Calculate ROI and ROE for each company for 2014. (Hint: You will need to calculate some of the numbers used in the denominator of these ratios.)b. Based on the results of your ROI and ROE analysis in part a , do you believe that either firm uses financial leverage more effectively than the other? Explain your answer. (Hint: Compare the percentage differences between ROI and ROE for each firm. Is there a significant difference that would suggest that one firm uses leverage more effectively than the other?)c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2014.

d. Compare the results of your analysis in part c to your expectations concerning the relative use of financial leverage in part b. Do the debt and debt/equity ratios calculated in part c make sense relative to your expectations? Explain your answer.

Required:

a. Calculate ROI and ROE for each company for 2014. (Hint: You will need to calculate some of the numbers used in the denominator of these ratios.)b. Based on the results of your ROI and ROE analysis in part a , do you believe that either firm uses financial leverage more effectively than the other? Explain your answer. (Hint: Compare the percentage differences between ROI and ROE for each firm. Is there a significant difference that would suggest that one firm uses leverage more effectively than the other?)c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2014.

d. Compare the results of your analysis in part c to your expectations concerning the relative use of financial leverage in part b. Do the debt and debt/equity ratios calculated in part c make sense relative to your expectations? Explain your answer.

التوضيح

(a) Calculate return on investment:

Ret...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255