Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

النسخة 11الرقم المعياري الدولي: 978-1259535314 تمرين 16

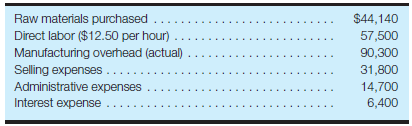

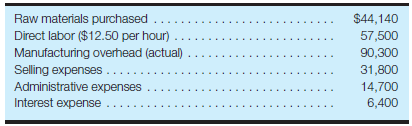

Cost of goods manufactured, cost of goods sold, and income statement Buck Company incurred the following costs during August:

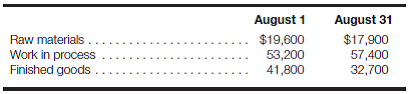

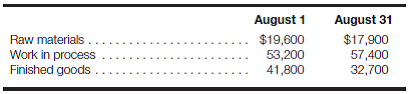

Manufacturing overhead is applied on the basis of $20 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the year. During the month, 4,200 units of product were manufactured and 4,400 units of product were sold. On August 1 and August 31, Buck Company carried the following inventory balances:

Required:

a. Prepare a statement of cost of goods manufactured for the month of August and calculate the average cost per unit of product manufactured.

b. Calculate the cost of goods sold during August.

c. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in the financial statements?

d. (Optional) Prepare a traditional (absorption) income statement for Buck Company for the month of August. Assume that sales for the month were $272,800 and the company's effective income tax rate was 34%.

Manufacturing overhead is applied on the basis of $20 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the year. During the month, 4,200 units of product were manufactured and 4,400 units of product were sold. On August 1 and August 31, Buck Company carried the following inventory balances:

Required:

a. Prepare a statement of cost of goods manufactured for the month of August and calculate the average cost per unit of product manufactured.

b. Calculate the cost of goods sold during August.

c. Calculate the difference between cost of goods manufactured and cost of goods sold. How will this amount be reported in the financial statements?

d. (Optional) Prepare a traditional (absorption) income statement for Buck Company for the month of August. Assume that sales for the month were $272,800 and the company's effective income tax rate was 34%.

التوضيح

a.

Cost of goods manufactured:

Cost of...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255