Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993 تمرين 40

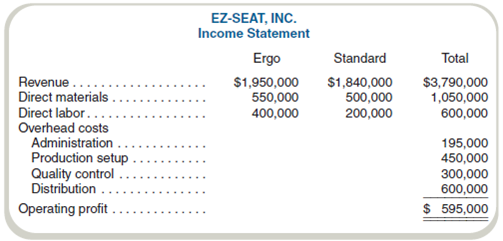

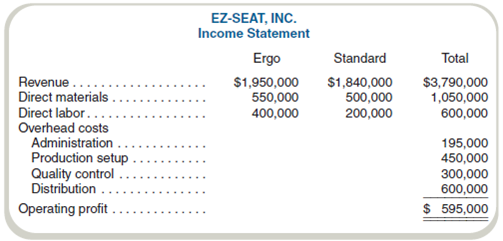

Comparative Income Statements and Management Analysis

EZ-Seat, Inc., manufactures two types of reclining chairs, standard and ergo. Ergo provides support for the body through a complex set of sensors and requires great care in manufacturing to avoid damage to the material and frame. Standard is a conventional recliner, uses standard materials, and is simpler to manufacture. EZ-Seat's results for the last fiscal year are shown in the following statement.

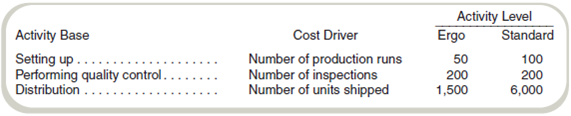

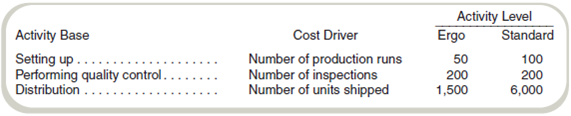

EZ-Seat currently uses labor costs to allocate all overhead, but management is considering implementing an activity-based costing system. After interviewing the sales and production staff, management decides to allocate administrative costs on the basis of direct labor costs but to use the following bases to allocate the remaining costs:

Required

a. Complete the income statement using the preceding activity bases.

b. Write a brief report indicating how management could use activity-based costing to reduce costs.

c. Restate the income statement for EZ-Seat using direct labor costs as the only overhead allocation base.

d. Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and why (if you believe it does provide more accurate information). Indicate in your report how the use of labor-based overhead allocation could cause EZ-Seat management to make suboptimal decisions.

EZ-Seat, Inc., manufactures two types of reclining chairs, standard and ergo. Ergo provides support for the body through a complex set of sensors and requires great care in manufacturing to avoid damage to the material and frame. Standard is a conventional recliner, uses standard materials, and is simpler to manufacture. EZ-Seat's results for the last fiscal year are shown in the following statement.

EZ-Seat currently uses labor costs to allocate all overhead, but management is considering implementing an activity-based costing system. After interviewing the sales and production staff, management decides to allocate administrative costs on the basis of direct labor costs but to use the following bases to allocate the remaining costs:

Required

a. Complete the income statement using the preceding activity bases.

b. Write a brief report indicating how management could use activity-based costing to reduce costs.

c. Restate the income statement for EZ-Seat using direct labor costs as the only overhead allocation base.

d. Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and why (if you believe it does provide more accurate information). Indicate in your report how the use of labor-based overhead allocation could cause EZ-Seat management to make suboptimal decisions.

التوضيح

Activity based Costing: Activity based c...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255