Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993 تمرين 2

Prepare Budgeted Financial Statements

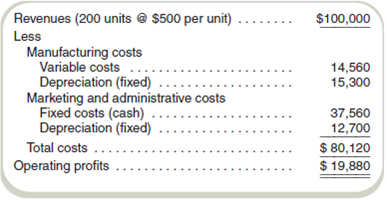

Rhodes, Inc., is a fast-growing start-up firm that manufactures bicycles. The following income statement is available for July:

Sales volume is expected to increase by 20 percent in August, but the sales price is expected to fall 10 percent. Variable manufacturing costs are expected to increase by 3 percent per unit in August. In addition to these cost changes, variable manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 10 percent.

Rhode's operates on a cash basis and maintains no inventories. Depreciation is fixed and should remain unchanged over the next three years.

Required

Prepare a budgeted income statement for August.

Rhodes, Inc., is a fast-growing start-up firm that manufactures bicycles. The following income statement is available for July:

Sales volume is expected to increase by 20 percent in August, but the sales price is expected to fall 10 percent. Variable manufacturing costs are expected to increase by 3 percent per unit in August. In addition to these cost changes, variable manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 10 percent.

Rhode's operates on a cash basis and maintains no inventories. Depreciation is fixed and should remain unchanged over the next three years.

Required

Prepare a budgeted income statement for August.

التوضيح

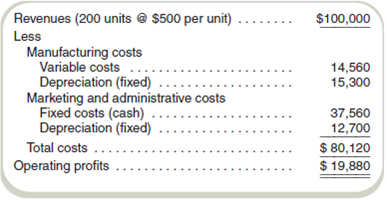

The budgeted income statement for August...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255