Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

النسخة 2الرقم المعياري الدولي: 978-0077274993 تمرين 28

Flexible Budget

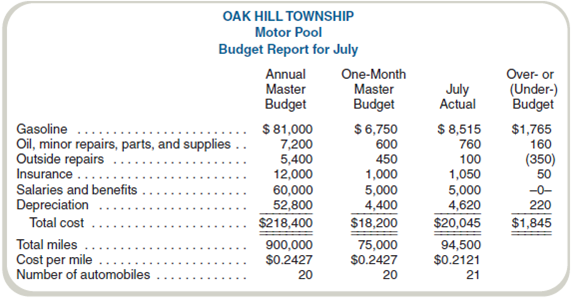

Oak Hill Township operates a motor pool with 20 vehicles. The motor pool furnishes gasoline, oil, and other supplies for the cars and hires one mechanic who does routine maintenance and minor repairs. Major repairs are done at a nearby commercial garage. Asupervisor manages the operations.

Each year, the supervisor prepares a master budget for the motor pool. Depreciation on the automobiles is recorded in the budget to determine the costs per mile.

The following schedule presents the master budget for the year and for the month of July.

The annual budget was based on the following assumptions:

1. Automobiles in the pool: 20.

2. Miles per year per automobile: 45,000.

3. Miles per gallon per automobile: 20.

4. Gas per gallon: $1.80.

5. Oil, minor repairs, parts, and supplies per mile: $0.008.

6. Outside repairs per automobile per year: $270.

The supervisor is unhappy with the monthly report, claiming that it unfairly presents his performance for July. His previous employer used flexible budgeting to compare actual costs to budgeted amounts.

Required

a. What is the gasoline monthly flexible budget and the resulting amount over- or underbudget (Use miles as the activity base.)b. What is the monthly flexible budget for the oil, minor repairs, parts, and supplies and the amount over- or underbudget (Use miles as the activity base.)c. What is the monthly flexible budget for salaries and benefits and the resulting amount over- or underbudget

d. What is the major reason for the cost per mile to decrease from $0.2427 budgeted to $0.2121 actual

(CMA adapted)

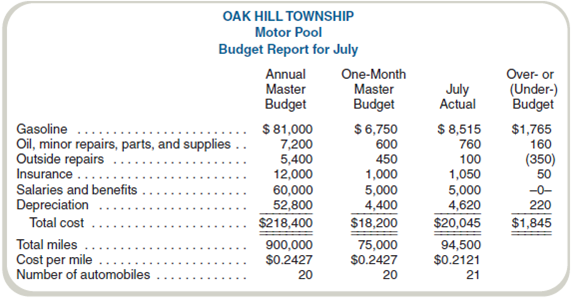

Oak Hill Township operates a motor pool with 20 vehicles. The motor pool furnishes gasoline, oil, and other supplies for the cars and hires one mechanic who does routine maintenance and minor repairs. Major repairs are done at a nearby commercial garage. Asupervisor manages the operations.

Each year, the supervisor prepares a master budget for the motor pool. Depreciation on the automobiles is recorded in the budget to determine the costs per mile.

The following schedule presents the master budget for the year and for the month of July.

The annual budget was based on the following assumptions:

1. Automobiles in the pool: 20.

2. Miles per year per automobile: 45,000.

3. Miles per gallon per automobile: 20.

4. Gas per gallon: $1.80.

5. Oil, minor repairs, parts, and supplies per mile: $0.008.

6. Outside repairs per automobile per year: $270.

The supervisor is unhappy with the monthly report, claiming that it unfairly presents his performance for July. His previous employer used flexible budgeting to compare actual costs to budgeted amounts.

Required

a. What is the gasoline monthly flexible budget and the resulting amount over- or underbudget (Use miles as the activity base.)b. What is the monthly flexible budget for the oil, minor repairs, parts, and supplies and the amount over- or underbudget (Use miles as the activity base.)c. What is the monthly flexible budget for salaries and benefits and the resulting amount over- or underbudget

d. What is the major reason for the cost per mile to decrease from $0.2427 budgeted to $0.2121 actual

(CMA adapted)

التوضيح

Flexible budget is based on actual activ...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255