Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700 تمرين 35

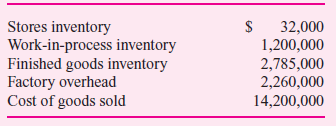

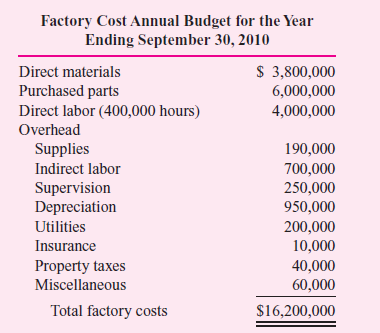

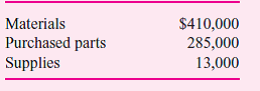

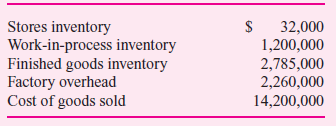

Targon Inc. manufactures lawn equipment. A job order system is used because the products are manufactured on a batch rather than a continuous basis. Targon employs a full absorption accounting method for cost accumulation. The balances in selected accounts for the 11-month period ended August 31, 2010, are presented below:

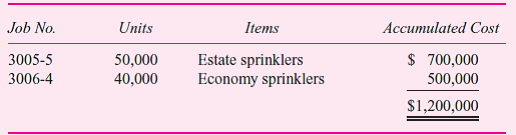

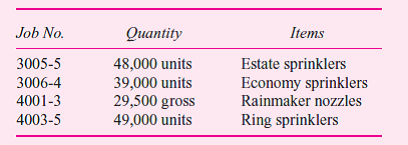

The work-in-process inventory consists of two jobs:

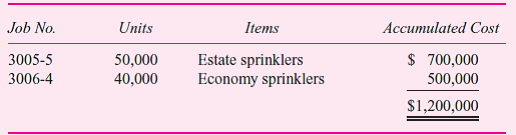

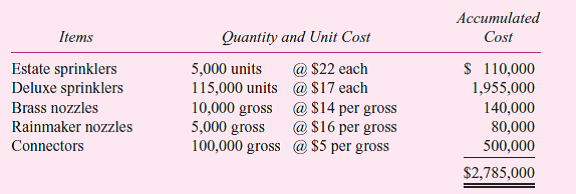

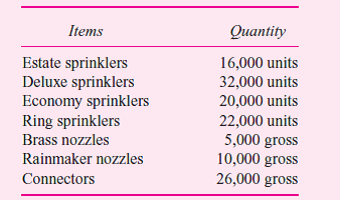

The finished goods inventory consists of five items:

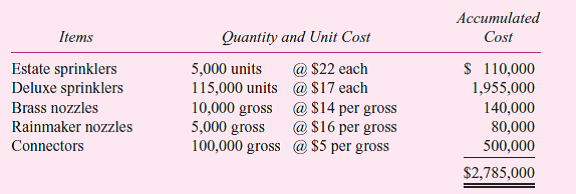

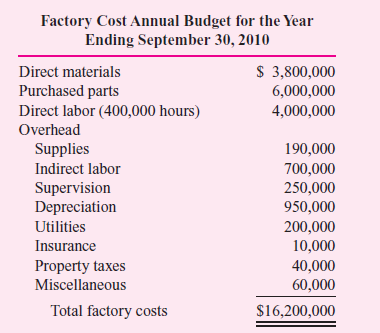

The factory cost budget prepared for the 2009-10 fiscal year is presented below. The company applies factory overhead on the basis of direct labor hours.

Activities during the first 11 months of the year were quite close to budget. A total of 367,000 direct labor hours have been worked through August 31, 2010.

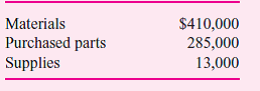

All direct materials, purchased parts, and supplies are charged to stores inventory. The September purchases were as follows:

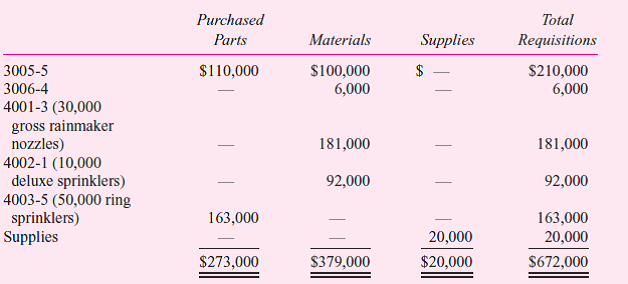

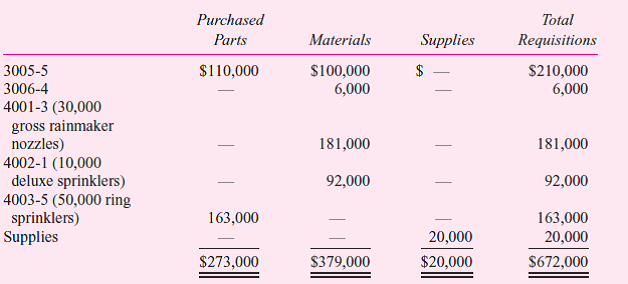

The direct materials, purchased parts, and supplies were requisitioned from stores inventory as shown in the table that follows:

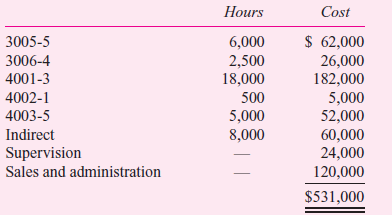

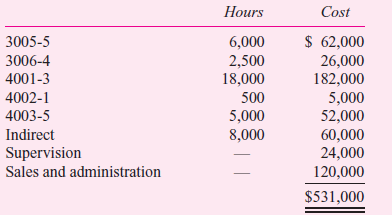

The payroll summary for September is as follows:

Other factory costs incurred during September were

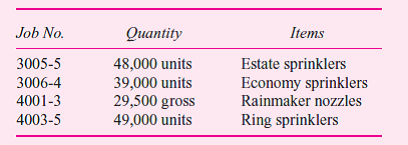

Jobs completed during September and actual output were

The following finished products were shipped to customers during September:

Required:

a. Calculate the over- or underapplied overhead for the year ended September 30, 2010. Be sure to indicate whether the overhead is over- or underapplied.

b. Calculate the dollar balance in the work-in-process inventory account as of September 30, 2010.

c. Calculate the dollar balance in the finished goods inventory as of September 30, 2010, for the estate sprinklers using a FIFO basis.

The work-in-process inventory consists of two jobs:

The finished goods inventory consists of five items:

The factory cost budget prepared for the 2009-10 fiscal year is presented below. The company applies factory overhead on the basis of direct labor hours.

Activities during the first 11 months of the year were quite close to budget. A total of 367,000 direct labor hours have been worked through August 31, 2010.

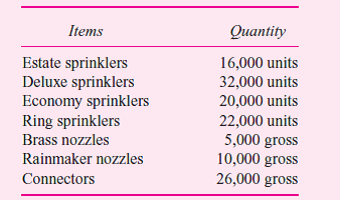

All direct materials, purchased parts, and supplies are charged to stores inventory. The September purchases were as follows:

The direct materials, purchased parts, and supplies were requisitioned from stores inventory as shown in the table that follows:

The payroll summary for September is as follows:

Other factory costs incurred during September were

Jobs completed during September and actual output were

The following finished products were shipped to customers during September:

Required:

a. Calculate the over- or underapplied overhead for the year ended September 30, 2010. Be sure to indicate whether the overhead is over- or underapplied.

b. Calculate the dollar balance in the work-in-process inventory account as of September 30, 2010.

c. Calculate the dollar balance in the finished goods inventory as of September 30, 2010, for the estate sprinklers using a FIFO basis.

التوضيح

Overheads are allocated to products base...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255