Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700 تمرين 3

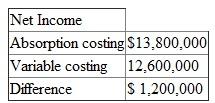

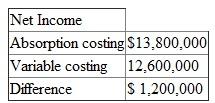

Federal Mixing (FM) is a division of Federal Chemicals, a large diversified chemical company. FM provides mixing services for both outside customers and other Federal divisions. FM buys or receives liquid chemicals and combines and packages them according to the customer's specifications. FM computes its divisional net income on both a fully absorbed and variable costing basis. For the year just ending, it reported

Overhead is assigned to products using machine hours.

Overhead is assigned to products using machine hours.

There is no finished goods inventory at FM, only work-in-process (WIP) inventory. As soon as a product is completed, it is shipped to the customer. The beginning inventory was valued at $6.3 million and contained 70,000 machine hours. The ending WIP inventory was valued at $9.9 million and contained 90,000 machine hours.

Required:

Write a short nontechnical note to senior management explaining why variable costing and absorption costing net income amounts differ.

Overhead is assigned to products using machine hours.

Overhead is assigned to products using machine hours.There is no finished goods inventory at FM, only work-in-process (WIP) inventory. As soon as a product is completed, it is shipped to the customer. The beginning inventory was valued at $6.3 million and contained 70,000 machine hours. The ending WIP inventory was valued at $9.9 million and contained 90,000 machine hours.

Required:

Write a short nontechnical note to senior management explaining why variable costing and absorption costing net income amounts differ.

التوضيح

Absorption vs. Variable Costing

In the ...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255