Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700 تمرين 6

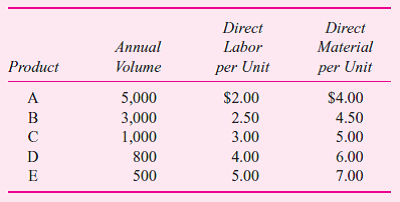

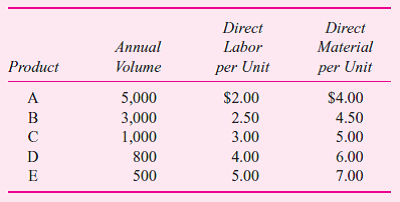

Brickley Chains produces five different styles of silver chains, A, B, C, D, and E, in a highly automated batch machining process. The following table summarizes the production and cost data for the five products.

Annual overhead is $80,000.

Required:

a. Compute the unit cost of each chain, A-E, using absorption costing. Overhead is assigned to individual products using direct labor cost.

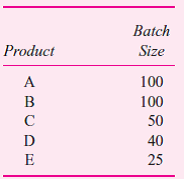

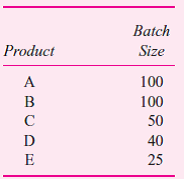

b. Upon further analysis, you discover that the annual overhead of $80,000 consists entirely of the highly automated machining process. Each chain type is produced in batches with chains of the same type. Each batch requires the same amount of machine time. That is, producing a batch of 100 style A chains requires the same amount of machine time as a batch of 25 style E chains. The following table summarizes the batch size for each type of chain:

Compute the unit cost of each chain, A-E, using activity-based costing.

c. Prepare a table comparing the activity-based cost and absorption cost of each product. Discuss why the product costs differ between the two costing methods.

Annual overhead is $80,000.

Required:

a. Compute the unit cost of each chain, A-E, using absorption costing. Overhead is assigned to individual products using direct labor cost.

b. Upon further analysis, you discover that the annual overhead of $80,000 consists entirely of the highly automated machining process. Each chain type is produced in batches with chains of the same type. Each batch requires the same amount of machine time. That is, producing a batch of 100 style A chains requires the same amount of machine time as a batch of 25 style E chains. The following table summarizes the batch size for each type of chain:

Compute the unit cost of each chain, A-E, using activity-based costing.

c. Prepare a table comparing the activity-based cost and absorption cost of each product. Discuss why the product costs differ between the two costing methods.

التوضيح

a. Absorption costing:

b. Activity-Ba...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255