Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

النسخة 6الرقم المعياري الدولي: 9780071283700 تمرين 17

Butler Products

A manufacturing company produces a large variety of products within the Butler family of products. They are produced in three finishing departments (A, B, and C), which have identical assembly operations but package the products differently for different lines of business.

Each finishing line packages units as either single units or multiple units per package. For allocating overhead, volume is defined in terms of machine hours. Each department can package 1,140 single units per hour.

Department A has the oldest equipment, which is in the last year of its depreciable life. Department B's equipment is about half depreciated. Department C's equipment is in the second year of its life.

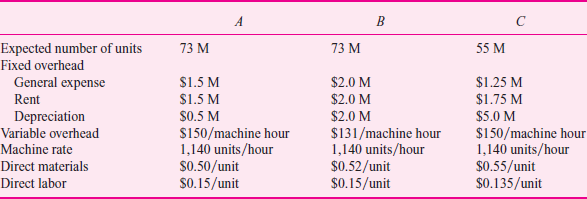

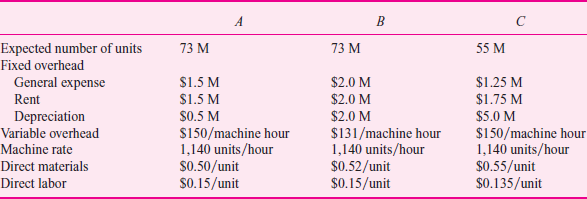

The budget prepared for each department in 2010 included the following costs, volumes, and overhead rates (M denotes millions):

The general expense portion of the overhead is set by each department at the beginning of the year for training, capital items under $2,500, and other department needs. The rent charged to each department is determined by the age and the structure of the building in which the department operates. In general, machines that are shut down because of volume decreases are not removed, so rent charges do not decrease with volume.

The company currently determines unit manufacturing cost (UMC) charges on a department basis, with one UMC for all types of products finished in that department. Under- or overabsorbed overhead is aggregated over the entire division and distributed to the departments based on normal volume.

The packaging machines in each department require different amounts of maintenance (variable overhead). In department A, the maintenance is higher because of older drive and logic systems. In department C, it is higher due to start-up costs that should decrease with time.

Direct materials costs depend on the products each department has been designated to run and the age of the equipment. They are outside the control of the department.

In 2010 Butler sales softened and not all of the capacity in departments A, B, and C is needed in 2011. Some capacity will be eliminated in one of the departments.

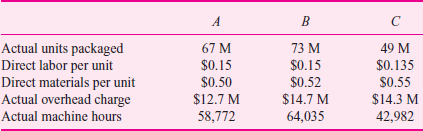

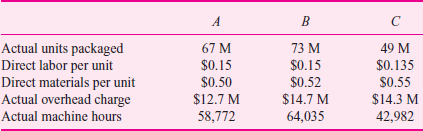

The UMCs for 2010 were as follows:

Required:

a. Calculate all variances. Which department best manages the overhead that is within its control

b. How would you recommend that the division distribute the fixed overhead that is not controllable by the departments

c. Given the reduced demand, which department should reduce volume Why

A manufacturing company produces a large variety of products within the Butler family of products. They are produced in three finishing departments (A, B, and C), which have identical assembly operations but package the products differently for different lines of business.

Each finishing line packages units as either single units or multiple units per package. For allocating overhead, volume is defined in terms of machine hours. Each department can package 1,140 single units per hour.

Department A has the oldest equipment, which is in the last year of its depreciable life. Department B's equipment is about half depreciated. Department C's equipment is in the second year of its life.

The budget prepared for each department in 2010 included the following costs, volumes, and overhead rates (M denotes millions):

The general expense portion of the overhead is set by each department at the beginning of the year for training, capital items under $2,500, and other department needs. The rent charged to each department is determined by the age and the structure of the building in which the department operates. In general, machines that are shut down because of volume decreases are not removed, so rent charges do not decrease with volume.

The company currently determines unit manufacturing cost (UMC) charges on a department basis, with one UMC for all types of products finished in that department. Under- or overabsorbed overhead is aggregated over the entire division and distributed to the departments based on normal volume.

The packaging machines in each department require different amounts of maintenance (variable overhead). In department A, the maintenance is higher because of older drive and logic systems. In department C, it is higher due to start-up costs that should decrease with time.

Direct materials costs depend on the products each department has been designated to run and the age of the equipment. They are outside the control of the department.

In 2010 Butler sales softened and not all of the capacity in departments A, B, and C is needed in 2011. Some capacity will be eliminated in one of the departments.

The UMCs for 2010 were as follows:

Required:

a. Calculate all variances. Which department best manages the overhead that is within its control

b. How would you recommend that the division distribute the fixed overhead that is not controllable by the departments

c. Given the reduced demand, which department should reduce volume Why

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255