Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 41

On January 1, 2015, Casey Corporation exchanged $3,300,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and accounting information systems.

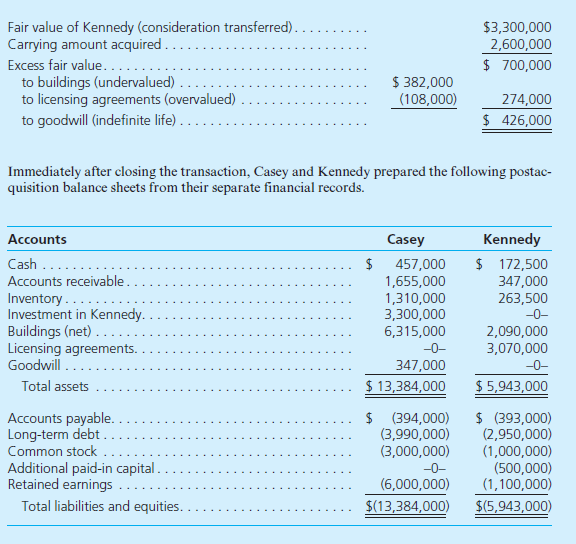

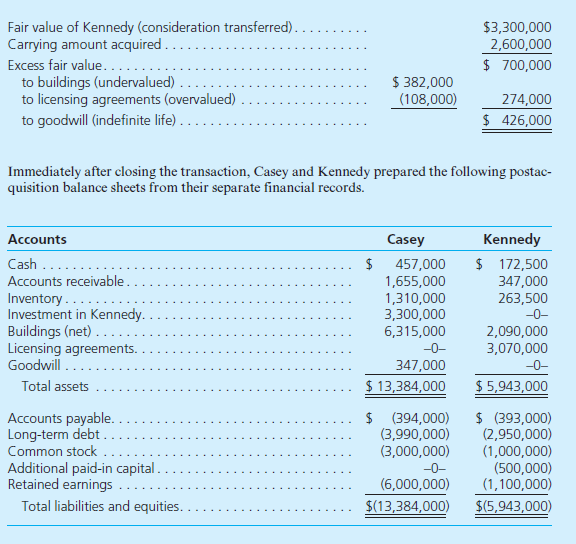

At the acquisition date, Casey prepared the following fair-value allocation schedule:

Prepare a January 1, 2015, consolidated balance sheet for Casey Corporation and its subsidiary Kennedy Corporation.

At the acquisition date, Casey prepared the following fair-value allocation schedule:

Prepare a January 1, 2015, consolidated balance sheet for Casey Corporation and its subsidiary Kennedy Corporation.

التوضيح

Wholly owned subsidiary with separate le...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255