Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 48

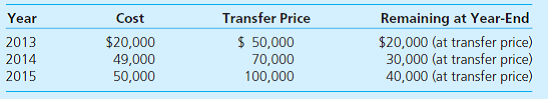

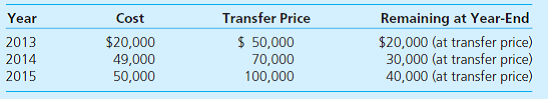

Anchovy acquired 90 percent of Yelton on January 1, 2013. Of Yelton's total acquisition-date fair value, $60,000 was allocated to undervalued equipment (with a 10-year remaining life) and $80,000 was attributed to franchises (to be written off over a 20-year period). Since the takeover, Yelton has transferred inventory to its parent as follows:

On January 1, 2014, Anchovy sold Yelton a building for $50,000 that had originally cost $70,000 but had only a $30,000 book value at the date of transfer. The building is estimated to have a 5-year remaining life (straight-line depreciation is used with no salvage value).

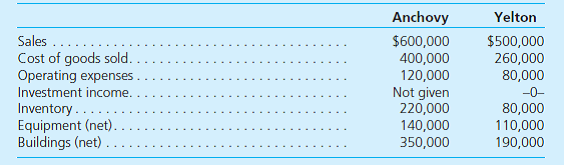

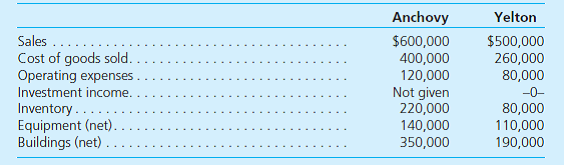

Selected figures from the December 31, 2015, trial balances of these two companies are as follows:

Determine consolidated totals for each of these account balances.

On January 1, 2014, Anchovy sold Yelton a building for $50,000 that had originally cost $70,000 but had only a $30,000 book value at the date of transfer. The building is estimated to have a 5-year remaining life (straight-line depreciation is used with no salvage value).

Selected figures from the December 31, 2015, trial balances of these two companies are as follows:

Determine consolidated totals for each of these account balances.

التوضيح

Consolidated financial statement:

A sta...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255