Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 36

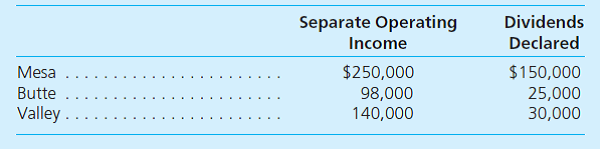

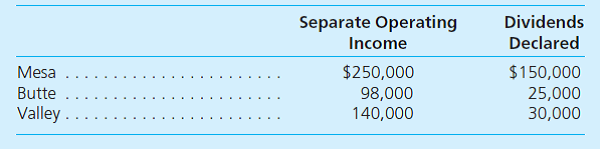

Mesa, Inc., obtained 80 percent of Butte Corporation on January 1, 2012. Annual amortization of $22,500 is to be recorded on the allocations of Butte's acquisition-date business fair value. On January 1, 2013, Butte acquired 55 percent of Valley Company's voting stock. Excess business fair-value amortization on this second acquisition amounted to $8,000 per year. For 2014, each of the three companies reported the following information accumulated by its separate accounting system. Separate operating income figures do not include any investment or dividend income.

a. What is consolidated net income for 2014

b. How is consolidated net income distributed to the controlling and noncontrolling interests

a. What is consolidated net income for 2014

b. How is consolidated net income distributed to the controlling and noncontrolling interests

التوضيح

Mesa, Inc. obtained 80% in Butte Corpora...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255