Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 18

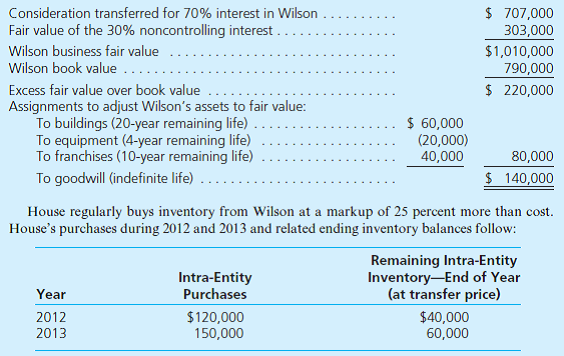

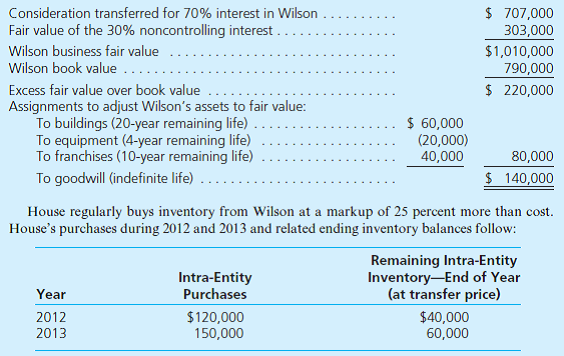

House Corporation has been operating profitably since its creation in 1960. At the beginning of 2012, House acquired a 70 percent ownership in Wilson Company. At the acquisition date, House prepared the following fair-value allocation schedule:

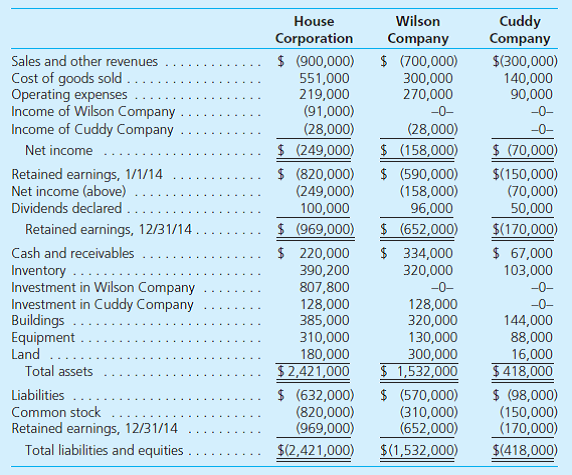

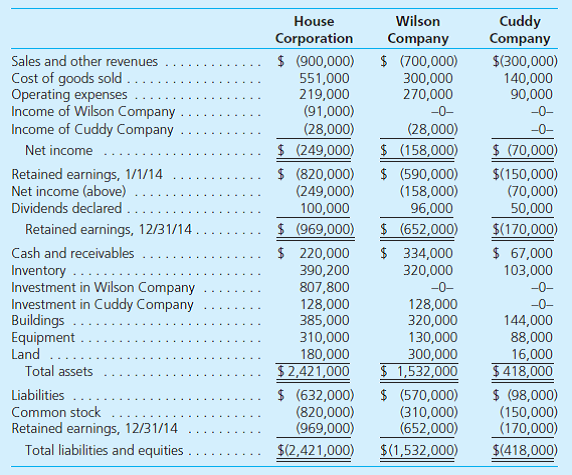

On January 1, 2014, House and Wilson acted together as co-acquirers of 80 percent of Cuddy Company's outstanding common stock. The total price of these shares was $240,000, indicating neither goodwill nor other specific fair-value allocations. Each company put up one-half of the consideration transferred. During 2014, House acquired additional inventory from Wilson at a price of $200,000. Of this merchandise, 45 percent is still held at year-end. Using the three companies' following financial records for 2014, prepare a consolidation worksheet. The partial equity method based on separate company incomes has been applied to each investment.

On January 1, 2014, House and Wilson acted together as co-acquirers of 80 percent of Cuddy Company's outstanding common stock. The total price of these shares was $240,000, indicating neither goodwill nor other specific fair-value allocations. Each company put up one-half of the consideration transferred. During 2014, House acquired additional inventory from Wilson at a price of $200,000. Of this merchandise, 45 percent is still held at year-end. Using the three companies' following financial records for 2014, prepare a consolidation worksheet. The partial equity method based on separate company incomes has been applied to each investment.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255