Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 30

On January 1, 2012, Alpha acquired 80 percent of Delta. Of Delta's total business fair value, $125,000 was allocated to copyrights with a 20-year remaining life. Subsequently, on January 1, 2013, Delta obtained 70 percent of Omega's outstanding voting shares. In this second acquisition, $120,000 of Omega's total business fair value was assigned to copyrights that had a remaining life of 12 years. Delta's book value was $490,000 on January 1, 2012 and Omega reported a book value of $140,000 on January 1, 2013.

Delta has made numerous inventory transfers to Alpha since the business combination was formed. Unrealized gross profits of $15,000 were present in Alpha's inventory as of January 1, 2014. During the year, $200,000 in additional intra-entity sales were made with $22,000 in gross profits remaining unrealized at the end of the period.

Both Alpha and Delta utilized the partial equity method to account for their investment balances.

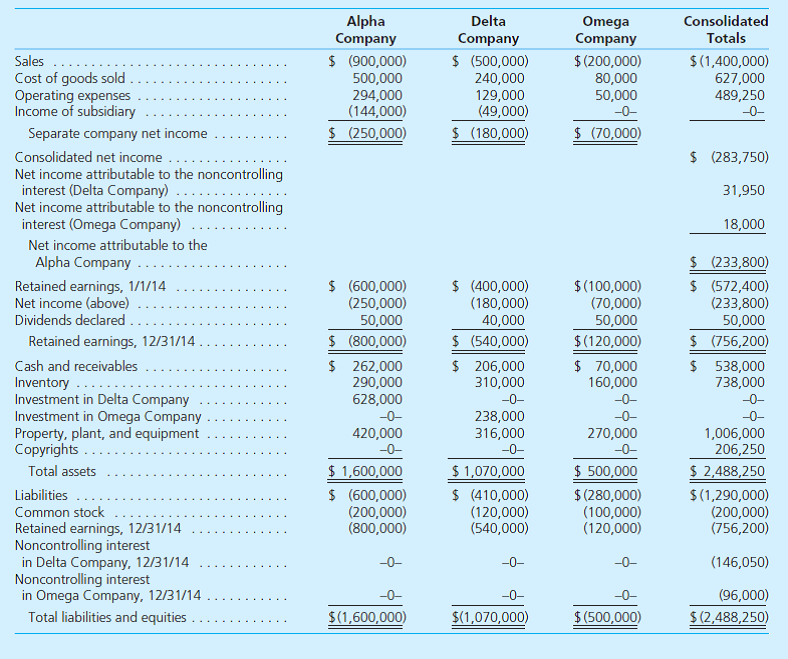

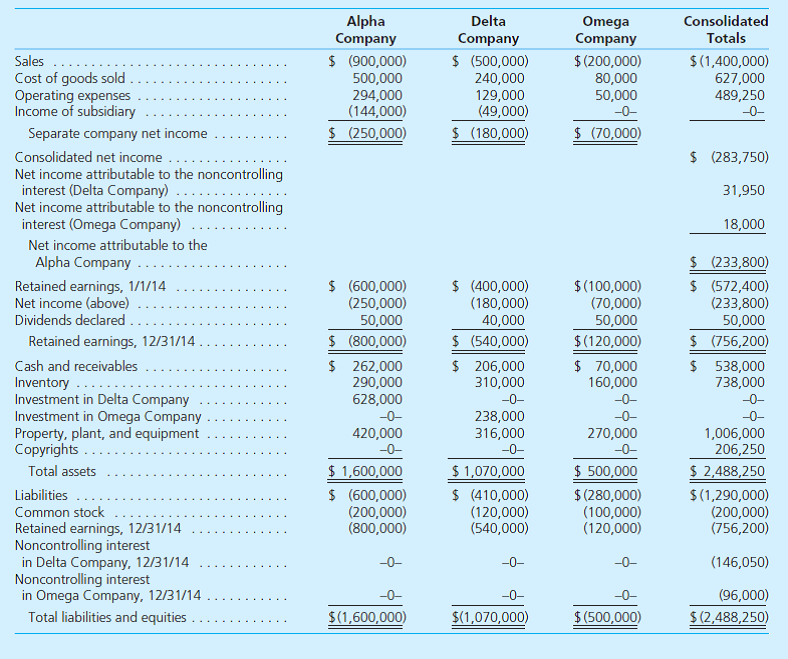

Following are the individual financial statements for the companies for 2014 with consolidated totals. Develop the worksheet entries necessary to derive these reported balances:

Delta has made numerous inventory transfers to Alpha since the business combination was formed. Unrealized gross profits of $15,000 were present in Alpha's inventory as of January 1, 2014. During the year, $200,000 in additional intra-entity sales were made with $22,000 in gross profits remaining unrealized at the end of the period.

Both Alpha and Delta utilized the partial equity method to account for their investment balances.

Following are the individual financial statements for the companies for 2014 with consolidated totals. Develop the worksheet entries necessary to derive these reported balances:

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255