Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 25

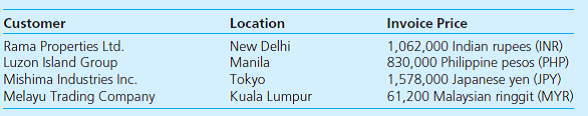

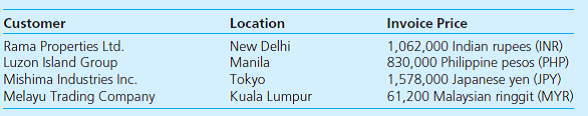

The Pier Ten Company, a U.S. company, made credit sales to four customers in Asia on October 15, 2012, and received payment on November 15, 2012. Information related to these sales is as follows:

The Pier Ten Company's fiscal year ends October 31.

Required

1. Use historical exchange rate information available on the Internet at www.x-rates.com , Historical Lookup, to find exchange rates between the U.S. dollar and each foreign currency for October 15, October 31, and November 15, 2012.

2. Determine the foreign exchange gains and losses that Pier Ten would have recognized in net income in the fiscal years ended October 31, 2012, and October 31, 2013, and the overall foreign exchange gain or loss for each transaction. Determine for which transaction it would have been most important for Pier Ten to hedge its foreign exchange risk.

3. Pier Ten could have acquired a one-month put option on October 15, 2012, to hedge the foreign exchange risk associated with each of the four export sales. In each case, the put option would have cost $100 with the strike price equal to the October 15, 2012, spot rate. Determine for which hedges, if any, Pier Ten would have recognized a net gain on the foreign currency option.

The Pier Ten Company's fiscal year ends October 31.

Required

1. Use historical exchange rate information available on the Internet at www.x-rates.com , Historical Lookup, to find exchange rates between the U.S. dollar and each foreign currency for October 15, October 31, and November 15, 2012.

2. Determine the foreign exchange gains and losses that Pier Ten would have recognized in net income in the fiscal years ended October 31, 2012, and October 31, 2013, and the overall foreign exchange gain or loss for each transaction. Determine for which transaction it would have been most important for Pier Ten to hedge its foreign exchange risk.

3. Pier Ten could have acquired a one-month put option on October 15, 2012, to hedge the foreign exchange risk associated with each of the four export sales. In each case, the put option would have cost $100 with the strike price equal to the October 15, 2012, spot rate. Determine for which hedges, if any, Pier Ten would have recognized a net gain on the foreign currency option.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255