Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 1

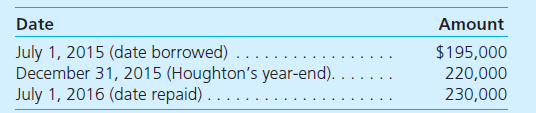

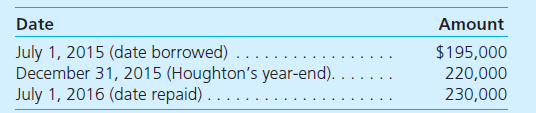

On July 1, 2015, Houghton Company borrowed 200,000 euros from a foreign lender evidenced by an interest-bearing note due on July 1, 2016. The note is denominated in euros. The U.S. dollar equivalent of the note principal is as follows:

In its 2016 income statement, what amount should Houghton include as a foreign exchange gain or loss on the note

a. $35,000 gain.

b. $35,000 loss.

c. $10,000 gain.

d. $10,000 loss.

In its 2016 income statement, what amount should Houghton include as a foreign exchange gain or loss on the note

a. $35,000 gain.

b. $35,000 loss.

c. $10,000 gain.

d. $10,000 loss.

التوضيح

Calculating foreign exchange gain or los...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255