Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

النسخة 12الرقم المعياري الدولي: 978-0077862220 تمرين 50

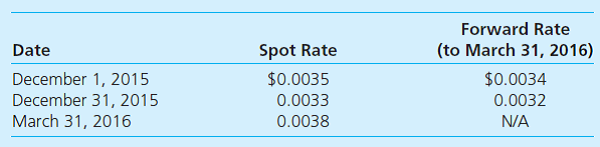

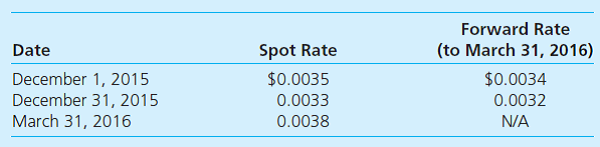

MNC Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2015, with payment of 10 million South Korean won to be received on March 31, 2016. The following exchange rates apply

MNC's incremental borrowing rate is 12 percent. The present value factor for three months at an annual interest rate of 12 percent (1 percent per month) is 0.9706.

Assuming that MNC did not enter into a forward contract, how much foreign exchange gain or loss should it report on its 2015 income statement with regard to this transaction

a. $5,000 gain.

b. $3,000 gain.

c. $2,000 loss.

d. $1,000 loss.

MNC's incremental borrowing rate is 12 percent. The present value factor for three months at an annual interest rate of 12 percent (1 percent per month) is 0.9706.

Assuming that MNC did not enter into a forward contract, how much foreign exchange gain or loss should it report on its 2015 income statement with regard to this transaction

a. $5,000 gain.

b. $3,000 gain.

c. $2,000 loss.

d. $1,000 loss.

التوضيح

Calculating foreign exchange g...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255